20, Feb 2026

CISI awards three new Honorary Fellowships

The board of the Chartered Institute for Securities & Investment (CISI) is delighted to announce that three Honorary Fellowships have been awarded to:

- Paul Stockton

- Debbie Clarke CF Chartered FCSI

- Danny Corrigan MCSI

Honorary Fellowships are awarded annually by the CISI’s Board of Trustees to individuals who have made an outstanding positive contribution, both to the financial services profession and to the CISI. Honorary Fellowship carries the designatory letters FCSI(Hon).

CISI Chair, Michael Cole-Fontayn MCSI, said: “The CISI Board and I are delighted to announce our highest accolade this year is awarded to three accomplished and outstanding financial services professionals. They are consummate role models for our next generation of sector talent with their commitment to lifelong learning and the CISI community. We look forward to their inspiration and leadership over the years ahead.”

Paul Stockton (left) began his career as a chartered accountant in 1988 with Price Waterhouse (PW) in Windsor specialising in financial services. After four years Paul accepted a position with PW in New York where he worked closely with insurance and asset management companies before returning to London in 1996. In 1999 he joined Old Mutual Plc as group financial controller, becoming finance director of wealth manager Gerrard Limited in 2001. In 2005, two years after the sale of Gerrard to Barclays, he left to work initially for Euroclear and then subsequently, as a divisional finance director of the Phoenix Group. Paul joined Rathbones Group Plc as Group Finance Director in 2008, serving until becoming Managing Director of Rathbones Investment Management in May 2018. In May 2019 Paul was appointed as Group Chief Executive at Rathbones, a role he enjoyed until his retirement in September 2025, two years after completing Rathbones’ merger with Investec Wealth UK.

Alongside his executive career Paul has served as a non-executive director of the Financial Services Compensation Scheme, as a board member of the Personal Investment Management and Financial Advice Association (PIMFA), and as a member of the FCA Practitioner Panel. Paul is a Freeman of the City of London.

Prior to taking on a NED portfolio career Debbie Clarke CF Chartered FCSI (right) was working within financial services, corporate finance and M&A since 1996 and held a number of leadership roles within the accountancy practices where she was an equity partner. During this time she directed M&A and refinancing projects for a wide range of clients. As an adviser she worked with a wide range of investors and organisations both public and private, within the UK and internationally and has a strong regulated background. She regularly presented at industry conferences and training sessions and assisted student training and mentoring as part of her portfolio.

Her experience has been across a variety of industries from education, sports, technology, real estate, manufacturing and support services where she has provided a range of strategic advice to her clients. Across her NED portfolio she has been chairing and vice chairing various board and committees and continues to advise private companies and their boards on their strategic plans.

Debbie became a member of the Chartered Institute for Securities & Investment (‘CISI’) in 1999 and started volunteering with CISI in 2007 when she was asked by a fellow Corporate Financier, Frank Moxon to help set up what has become the Corporate Finance & Capital Markets Forum. Working together with Frank and others for many years in relaunching the Diploma in Corporate Finance and championing professionalism in wholesale markets has been a passion during her career. She became a non-executive Director of the CISI in 2017 a post she held for six years before stepping down to focus on her Trustee role on the Chartered Institute for Securities & Investment Future Foundation (‘Future Foundation ‘) which the CISI set up in 2022. In 2022 Debbie was awarded the Freedom of the City of London. Debbie has been and continues to be a mentor and supporter of many people throughout their careers in financial services.

Danny Corrigan MCSI (left) is a senior manager with 40 years’ experience of the wholesale financial markets as a London based Director, Managing Director, and CEO leading teams across a range of asset classes including fixed income and derivatives. He also has extensive international experience having worked locally in the markets of Moscow, Sydney, Tokyo, and others.

He has worked as a banker, trader, and broker, for a dozen firms, has written five books on the markets and has an extensive network in the city. He has sat on various central bank committees and was seconded to London Clearing House, a crucial part of the global market infrastructure, as part of an industry wide response to the default of Lehman Brothers to lead the closure of its trading books.

Danny and his co-founders launched London Reporting House, a fin-tech start-up in April 2023, has funding, wonderful employees, and a perfect little office in the alleyways of Bow Lane. He was also a Trustee and Board member of the Chartered Institute for Securities & Investment and chaired its International Committee. He spent years promoting the City of London with non-for-profit promotional bodies including the Lord Mayor / Mansion House and was formerly Chair of the Eurasia Group at TheCityUK.

He graduated in Economics from the University of Liverpool in 1981 and has an MBA (Finance) from City University. He is married to Kerrie, and they are proud parents of three sons; an actor James, Ben a co-founder of London Reporting House and an earlier survivor of ‘Dragon’s Den’, Luke an accomplished professional and are grandparents to Wren.

Danny is a retired Football Association coach having led Hampstead FC youth teams to glory in the 2000s and he was an occasional referee. He stood for the Brexit Party in the unwinnable seat of Hornsey & Wood Green in 2019 and came 5th.

- 0

- By Neel Achary

20, Feb 2026

Funding Annapurna Finance Raises USD 100 Million through Syndicated Multi-Currency Social Loan Facility

Bhubaneswar, Feb 20 : Annapurna Finance Private Limited has secured a USD 100 million through syndicated multi-currency term loan facility, along with a USD 50 million greenshoe option. The facility, denominated in USD and JPY, marks a significant step in enhancing Annapurna Finance’s access to new currencies and international lenders, the facility structured as a social loan underscores the organisation’s continued commitment to inclusive and responsible finance. Standard Chartered Bank acted as the Sole Mandated Lead Arranger, Underwriter, and Bookrunner, successfully leading the transaction with deep expertise and execution capability. Commenting on the transaction, Mr Dibyajyoti Pattanaik, Director Annapurna Finacne Private Limited said,

“This transaction is more than fundraising—it’s a defining milestone for our institution. In a challenging global and liquidity environment, its size and timing reflect strong confidence in Annapurna’s model and governance. Diversified, long-term global capital strengthens our balance sheet and reinforces our commitment to sustainable financial inclusion, women empowerment and climate resilience in India.”

This transaction builds on the company’s USD 109.5 million syndicated loan facility concluded last year, also led by Standard Chartered Bank, and reflects sustained market confidence in Annapurna Finance’s business model, governance framework, and execution strength.

Annapurna Finance Private Limited (AFPL) is one of India’s leading non-banking financial companies and ranks as the fourth-largest NBFC–MFI in the country, anchored in a strong customer-centric and responsible lending framework, Annapurna combines a wide on-ground distribution network with technology-enabled processes to enhance access, efficiency, and transparency. The institution remains committed to advancing sustainable financial inclusion by expanding formal credit access, strengthening household resilience, and supporting micro-entrepreneurship across its operational footprint.

20, Feb 2026

NICMAR’s Bharat Nav-Nirmaan Challenge: Mumbai City Round Concludes, Students Showcase Innovative Infra Solutions

Mumbai, Feb 20th: The Mumbai City Round of the Bharat Nav–Nirmaan Challenge, NICMAR’s flagship and nationwide student innovation initiative, concluded in the Maximum City, bringing together undergraduate engineering and architecture students to present practical solutions to real-world infrastructure challenges.

The city–round finale saw more than 20 teams participating from leading institutions across Mumbai and Maharashtra, with student teams showcasing projects focused on addressing India’s built environment and other infrastructure challenges. The competition forms part of a structured, multi-stage national platform designed to encourage young technical talent to engage with India’s fast-evolving Construction, Real Estate, Infrastructure and Project (CRIP) sectors.

Projects were evaluated by an industry jury comprising Dr. Smita Patil (Dean – School of Engineering, NICMAR University, Pune), Mr. Yayati Kene (Co-Founder & CEO at Amala Realty) and Ms. Sanika Sarang Andhale (Former Vice President-Planning, Nahar Group) who assessed entries on innovation, feasibility, scalability and relevance to current infrastructure demands. The jury noted the strong application of technical fundamentals combined with practical implementation thinking.

Congratulating the winners of Mumbai city–round and highlighting the importance of such challenges, Dr Tapash Kumar Ganguli, Director-General, NICMAR said, “The objective of the Bharat Nav–Nirmaan Challenge is to give students exposure to real infrastructure problem statements early in their academic journey. The quality of solutions presented at the Mumbai City Round reflects the growing interest among young engineers in contributing to India’s built environment.”

The winners of the Mumbai City Round are:

- 1st – Datta Meghe College of Engineering, Airoli

- 2nd – Pillai HOC College of Engineering & Technology, Rasayani

- 3rd – L S Raheja College of Architecture, Mumbai

These winning teams will advance to the regional round of the challenge, competing with top teams from other cities across India.

Supported by the All India Council for Technical Education (AICTE), the Bharat Nav–Nirmaan Challenge is an initiative aimed at encouraging undergraduate students to solve real-world infrastructure challenges, which has evolved into one of India’s largest student-led innovation movements focused on the built environment, with prizes worth Rs 30 lakh.

20, Feb 2026

Liquibase Secure 5.1 Extends Modeled Change Control to Snowflake

New release makes Snowflake control plane changes governable and auditable across access, data movement, and execution, and adds support for Couchbase, AWS Keyspaces, DataStax Enterprise, and AlloyDB.

Austin, TX — Feb 20— Liquibase, the leader in Database Change Governance, today announced the release of Liquibase Secure 5.1, extending modeled Change Control to Snowflake. With 5.1, enterprises can govern Snowflake control plane changes with the same rigor and automation they already apply to schema evolution, closing a critical gap in data platform security, compliance, and AI readiness. Liquibase Secure 5.1 also expands database platform coverage, including new support for additional cloud and enterprise data stores.

Snowflake has become mission-critical infrastructure for analytics, data products, and AI initiatives. As organizations scale DataOps and internal developer platforms, Snowflake changes are no longer isolated technical updates. They are platform-level changes that impact trust, availability, and every downstream consumer. Yet many of the most consequential changes still happen outside standardized governance, often delivered as scripts with limited visibility, weak enforcement, and evidence that is difficult to assemble when it matters most.

“As enterprises modernize their developer platforms for AI-driven delivery, change control at the database layer has become a prerequisite, not a nice-to-have,” said Mirek Novotny, Sr. Director of Product at Liquibase. “If Snowflake control plane changes aren’t governed and observable, you can’t prove control. Liquibase Secure 5.1 brings predictability and evidence to the changes that matter most, without slowing teams down.”

Modeled Change Control for Snowflake

Liquibase Secure 5.1 treats key Snowflake control plane changes as first-class, modeled change types, rather than opaque scripts. That modeling enables precise policy enforcement, object-aware drift detection, and audit-ready evidence at the level where access, movement, and execution are defined.

With Liquibase Secure 5.1, data platform teams can govern Snowflake changes across access and security configuration, data sharing and movement, platform and cost controls, and automated execution, using standardized workflows across environments and teams.

Key outcomes include:

- Stop risky Snowflake control plane changes before they reach production

- Standardize how Snowflake changes are delivered across environments and teams

- Automatically generate audit-ready evidence for every change

- Detect drift and out-of-band updates to governed Snowflake objects

- Recover faster with traceable, reversible changes and tested rollback procedures

This closes a long-standing gap for organizations that govern schema evolution, yet still struggle with over-permission creep, ungoverned data movement, and control plane drift that can undermine security posture and AI initiatives.

Built for DataOps, data products, and AI readiness

As Snowflake increasingly powers feature engineering, model training, and AI-driven decisioning, the blast radius of ungoverned change grows. A single access change can expose sensitive training data. An unreviewed sharing update can expand compliance scope. An execution change can silently alter business-critical logic. Liquibase Secure 5.1 helps data platform teams keep Snowflake predictable, auditable, and reliable as usage scales, without turning governance into a bottleneck.

Expanding database support across Liquibase’s industry-leading coverage

Liquibase Secure continues to deliver broad database coverage across 60+ platforms, from mainframe DB2 to cloud-native data stores. Liquibase Secure 5.1 expands support for Snowflake, Databricks, and MongoDB, and adds new platform support for Couchbase, AWS Keyspaces, DataStax Enterprise, and AlloyDB for Google Cloud. This breadth helps enterprises standardize change governance across heterogeneous environments using a single platform instead of stitching together siloed tools and processes. Teams can apply consistent workflows and generate unified, audit-ready evidence across their database estate, reducing operational overhead while preserving the flexibility to adopt new technologies without rebuilding governance each time.

Enterprise partnership, not just tooling

Liquibase brings more than a decade of frontline experience helping enterprises govern database change at scale. In addition to the platform, Liquibase provides hands-on professional services, a dedicated customer success organization, and ongoing advisory support to help teams operationalize Change Control across their delivery model.

20, Feb 2026

Regional Community Radio Sammelan (North) Highlights Growth, Innovation and Sustainability of Community Radio Sector

Chandigarh, Feb 20: The two-day Regional Community Radio Sammelan (North) was inaugurated in Chandigarh. Organised by the Ministry of Information & Broadcasting, Government of India, in collaboration with the Indian Institute of Mass Communication (IIMC), New Delhi, the theme of the Sammelan is “Celebrating 20 Years of Community Radio in India.” More than 75 Community Radio Stations from the Northeastern region are participating in the event.

Addressing the gathering, Ms. Shilpa Rao, Director (CRS), Ministry of Information and Broadcasting, emphasized that while the Ministry is actively expanding the community radio network, stakeholders must come forward to share their experiences and success stories to further consolidate the sector. She also highlighted that several new innovations are being introduced to support the sustained growth of community radio.

Speaking on the occasion, Shri L. Madhu Nag, Registrar, Indian Institute of Mass Communication (IIMC), noted that although content continues to be the backbone of community radio, the sector faces challenges in terms of trained manpower. He stressed the importance of developing sustainable operational models and prioritizing the adoption of technology to address these challenges effectively.

During a technical session, Shri Manish Sheelwant, Deputy Director, Wireless Planning and Coordination Wing, simplified the Saral Sanchar Portal process for participants by clearly explaining procedures related to approvals, auto-renewals, and spectrum charges, thereby making regulatory requirements easier to understand and comply with.

Another key session was conducted by Shri Sri Sai Vempati, Deputy Director (AV), Central Bureau of Communication (CBC), MIB, who provided detailed insights into the empanelment process and highlighted the role of government advertising in enhancing the outreach and sustainability of community radio stations.

An experience-sharing session featured representatives from Radio Salam Namaste, Sanjha Radio, and Radio Hewalvani, who shared practical insights on content creation, sustaining community radio stations and engaging effectively with district and state administrations.

Concluding the series of sessions, Shri Ashwini Kumar from Akashvani delivered an informative presentation on content creation and the AIR Code of Ethics, emphasizing responsible broadcasting and adherence to ethical standards in community radio operations.

On the second day, the Sammelan will feature sessions on the NaVigate Bharat portal, a presentation by the Ministry on documentation, and discussions on participation, including the sharing of studies, reports on CRS and stakeholder experiences.

The Sammelan provides Community Radio practitioners a platform to share experiences, raise concerns, explore innovative approaches and collectively strengthen the future of grassroots broadcasting across the northeastern region.

19, Feb 2026

INSHUR Appoints Christopher Aragon as Head of US Sales and Operations to Drive Growth and Expand Mobility Insurance Footprint

Executive from Turo and Outdoorsy will oversee the company’s revenue engine and sales operations, supporting commercial growth across the car share and mobility insurance industry

(New York, NY, February 19, 2026) – INSHUR, the leader in insurance solutions for the on-demand economy, announced today the appointment of Christopher Aragon as Head of US Sales and Operations. In this role, Aragon will be responsible for overseeing the company’s revenue engine and commercial operations, with a focus on scaling profitable growth, strengthening execution across sales functions, and ensuring tight coordination between commercial strategy and execution as INSHUR continues to expand globally.

Aragon joins INSHUR with more than 20 years of experience in the insurance and mobility industry, having held senior leadership roles at Tint, Outdoorsy/Roamly, Turo, and Progressive. His background spans sales, underwriting, claims, risk management, and automation, with a focus on designing and scaling data-driven insurance programs for shared economy, fleet, and gig-driver ecosystems, aligning closely with INSHUR’s mission to build insurance infrastructure designed for how mobility actually works today.

“Christopher brings a strong blend of expertise and insights thanks to his successes in building data-driven insurance programs across the on-demand mobility economy,” said Dan Bratshpis, CEO and co-founder of INSHUR. “His experience at leading mobility and insurance companies gives us valuable perspective on where the market is headed and where we can push it forward. As we scale our first-to-market Off-rental (Period X™) and On-rental (Period Z) car share products, his expertise in this category will be invaluable. His deep understanding of the on-demand economy allows him to translate complex regulatory and operational constraints into innovative products and scalable commercial systems that customers actually need.”

“I was drawn to INSHUR by the environment they’ve created at the intersection of deep insurance knowledge and modern mobility needs,” said Aragon. “The company’s focus on building durable and cohesive systems is a flywheel where revenue growth, operational integrity, and customer outcomes are constantly reinforcing each other. It’s a rare combination, and I believe it’s the foundation for carrying on the future of mobility insurance in both a responsible and sustainable manner.”

With over 40 million people in the US involved in gig economy work, rideshare and delivery drivers are the backbone of the on-demand economy, powering one of the biggest economic shifts in decades. INSHUR supports this workforce by simplifying commercial insurance for rideshare, carshare, and last mile delivery, aligning coverage with real driving activity to build trust between drivers, platforms, and insurers. Through embedded, flexible commercial auto insurance, INSHUR enables coverage that fits how people actually work today.

19, Feb 2026

Next-generation OLEDs rely on finetuned microcavities

Researchers have developed a unified theory of microcavity OLEDs, guiding the design of more efficient and sustainable devices. The work reveals a surprising trade-off: squeezing light too tightly inside OLEDs can actually reduce performance, and maximum efficiency is achieved through a delicate balance of material and cavity parameters. Organic light-emitting diodes (OLEDs) offer several attractive advantages over traditional LED technology: they are lightweight, flexible, and more environmentally friendly to manufacture and recycle. However, heavy-metal-free OLEDs can be rather inefficient, with up to 75% of the injected electrical current converting into heat.

OLED efficiency can be enhanced by placing the device inside an optical microcavity. Squeezing the electromagnetic field forces light to escape more rapidly instead of wasting energy as heat.

“It is basically like squeezing toothpaste out of a tube,” explains Associate Professor Konstantinos Daskalakis from the University of Turku in Finland.

After a certain squeezing threshold, the original energy levels of the emitting material and the electromagnetic field hybridize. These mixed light–matter states are known as polaritons.

While the static energy levels of polariton OLEDs are well understood, much less is known about how the squeezing affects transitions between these states. As a result, the development of polariton OLEDs has largely relied on trial and error.

Now, a research group at the University of Turku has developed the first theoretical model that explains how these transition mechanisms change as the squeezing increases. Surprisingly, the model predicts that efficiencies decrease once polaritons are formed. This reduction arises from two distinct effects.

“Although polaritons emit light very quickly, they are shared states of typically hundreds of thousands of molecules, which dilutes the processes populating them,” explains Postdoctoral Researcher Olli Siltanen. “These population mechanisms can be further weakened if the polariton energies lie too far from the original molecular energy levels.”

According to the model, maximum efficiency in microcavity OLEDs is achieved through a delicate balance of material and cavity parameters. While the model finds polaritons with many molecules disadvantageous, all hope is not lost.

“Alternative device architectures allow us to reduce the number of molecules involved from hundreds of thousands to just a few,” says Daskalakis. “Such OLEDs have the potential to achieve record-breaking efficiencies.”

The results have been published in the journal Materials Horizons.

Read the research article: https://pubs.rsc.org/en/content/articlelanding/2026/mh/d5mh01958c#!divAbstract

19, Feb 2026

UAE Establishes First Integrated Metals Education Ecosystem with World Steel Association

Metal Park Forms Strategic National Alliance with World Steel Association and Steel University to Build the Middle East’s First Integrated Metals Education Ecosystem (MEEEM)

Abu Dhabi, UAE — Feb 19: Metal Park has signed a strategic agreement with the World Steel Association and

Steel University, establishing a national-level alliance to develop a fully integrated metals education and capability ecosystem for the Middle East.

Witnessed by H.E. Dr. Sultan Jaber, Minister of Industry and Advanced Technology; Captain Mohamed Juma Al Shamisi, Managing Director and Group CEO of AD Ports Group; and Mr. Vahid Fouladkar, CEO of Metal Park and signed by Navid Fouladkar, Head of Strategic Partnerships at Metal Park, and Jorge Muract, Director of Steel University.

This milestone partnership directly supports the UAE’s industrial vision under Make it inthe Emirates and Operation 300bn, reinforcing the country’s ambition to build globally competitive, value-added metal production capabilities from within the UAE.

The alliance positions Metal Park not only as industrial infrastructure, but as the execution layer where education, standards, talent, and production converge into a single operating ecosystem.

Vahid Fouladkar, CEO of Metal Park, said: “This alliance marks a defining step in how industrial growth is built and sustained in the region. Metal Park was conceived as more than physical infrastructure—it is an operating

ecosystem where standards, talent, capability, and production are developed together. By partnering with the World Steel Association and Steel University, we are embedding global best practices directly into the industrial environment, ensuring that education translates into measurable performance, competitiveness, and long-term national value for the UAE.”

Jorge Muract, Director of Steel University, stated: The alliance seeks to secure the industry talent pipeline through strong collaboration and alignment among academia, industry, its value chain, and government as a key enabler of this interaction, while also providing agile infrastructure to continuously upskill and reskill the workforce and sustain innovation in production systems. Together, we aim to develop high-quality learning and technology solutions that build a more efficient and dynamic workforce. At the same time, the alliance seeks to join efforts with

similar initiatives in Europe, Saudi Arabia, India and Latin America to create a global education and training ecosystem that enables talent mobility and ensures equal access to education and training, fostering social innovation worldwide.

Abdullah Al Hameli, CEO of Economic Cities & Free Zones, AD Ports Group, said: “This agreement strengthens the foundation of our industrial ecosystem by aligning global standards with local production capability. KEZAD Group not only provides infrastructure, but also enables performance. By embedding internationally recognised expertise from the World Steel Association and Steel University directly into Metal Park’s operating environment, we are

accelerating the development of advanced industrial skills, raising productivity, and enhancing the competitiveness of UAE-based manufacturers.

“This initiative directly supports national industrial priorities under Make it in the Emirates and Operation 300bn, and reinforces Abu Dhabi’s position as a globally competitive hub for value-added metal production, driven by capability, standards, and long-term industrial resilience.”

From Global Standards to Industrial Output

At the core of the agreement is a shared commitment to transforming skills development into measurable industrial performance. Through collaboration with the World Steel Association and Steel University, Metal Park will embed internationally recognised standards, certifications, technical frameworks, and sector intelligence directly into its operating environment—ensuring education is applied at the factory-floor level, not abstract.

This ecosystem-driven model ensures that learning, certification, and best practices translate into higher productivity, improved quality, and enhanced competitiveness across UAE-based metal production.

Advancing National Industrial Priorities and Regional Workforce Capability The partnership directly contributes to the objectives of Make it in the Emirates and Operation 300bn by:

- Strengthening domestic metal and steel industrial capability

- Developing future-ready technical, engineering, and operational talent

- Embedding global standards into local production environments

- Enhancing the long-term competitiveness and resilience of regional manufacturing

By connecting global industry leadership with Metal Park’s integrated infrastructure, the alliance ensures that industrial growth is powered by world-class assets, standards, and people.

Building the Middle East’s Metals Education & Capability Ecosystem

The agreement underpins Metal Park’s long-term vision to establish the region’s most comprehensive metals education and capability ecosystem—spanning foundational skills, advanced metallurgy, engineering, processing, and operational excellence.

This phased, scalable approach ensures that capability building is aligned with real industrial demand, national priorities, and long-term sustainability. Metal Park views this agreement as a foundation for broader collaboration. Delivering a globally recognised industrial talent and standards ecosystem will require continued engagement with government entities, regulators, academic institutions, and industry partners—anchored by Metal Park as the ecosystem platform.

19, Feb 2026

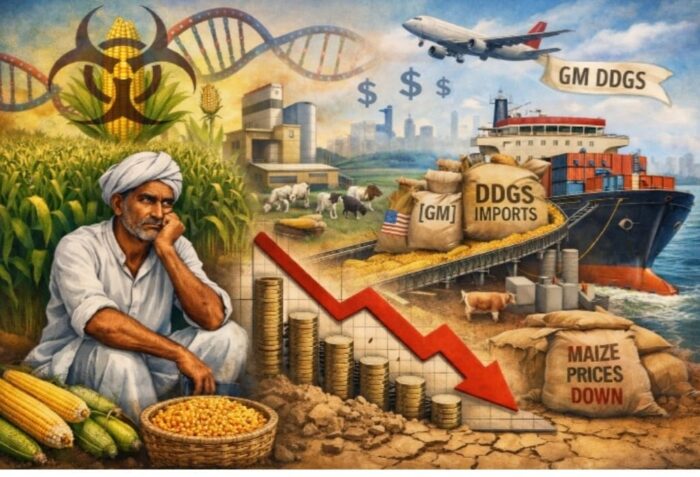

A Measured Trade Step, A Wider Rural Conversation

By Dr Mamtamayi Priyadarshini

A balanced reflection from a pro–non-GM advocacy perspective

India’s recent decision to allow concessional imports of dried distillers’ grains with solubles (DDGS) under the interim trade framework with the United States has sparked discussion across agricultural and feed industry circles. The government has capped imports at 500,000 tonnes — approximately 1% of domestic consumption — and positioned the measure as a calibrated step aimed at easing feed costs for poultry, dairy and aquaculture sectors.

At first glance, the policy appears limited in scope. Yet agricultural markets are shaped not only by volumes, but also by signals. Even relatively modest trade concessions can influence price expectations, bargaining power and rural income structures in ways that extend beyond their numerical share.

Understanding DDGS in the Broader Context

DDGS is a protein-rich by-product of maize-based ethanol production. In the United States — where most maize cultivation is genetically modified — DDGS is produced at industrial scale and widely used as animal feed. For India, the question is not merely about substituting one feed ingredient for another. It is about how such imports may interact with domestic maize markets, farmer incomes and India’s precautionary approach toward genetically modified crops.

Policymakers have emphasized the potential for cost relief to livestock industries. That objective is understandable, particularly in sectors that directly influence food prices and nutritional security. At the same time, it is worth examining how the distribution of benefits and risks may unfold across different stakeholders.

The Subtle Dynamics of Market Signals

On paper, a 1% import quota seems modest. In practice, however, imports can establish a reference price in the market. Large feed manufacturers and integrated poultry companies now have an additional sourcing option. This potentially strengthens their negotiating leverage when purchasing domestic maize or soybean meal.

In commodity markets, perception can influence pricing as much as supply volumes do. If buyers can point to lower-cost imported DDGS, domestic suppliers may feel pressure to align prices accordingly. Even before significant quantities enter the supply chain, the signalling effect alone can shape market sentiment.

For India’s maize farmers — many of whom operate on thin margins — these shifts can matter. Rising input costs for hybrid seeds, fertilizers, irrigation and transportation already weigh heavily. Limited storage infrastructure often compels farmers to sell soon after harvest, reducing their ability to wait for favorable price cycles. In such conditions, even a 5–10% softening in farmgate prices can meaningfully affect annual household income.

Distribution of Gains and Pressures

The potential advantages of DDGS imports are likely to accrue primarily to large feed integrators and industrial processors, who may benefit from diversified sourcing and improved margins. Whether such cost efficiencies translate into lower consumer prices for poultry, dairy or aquaculture products remains uncertain and depends on value-chain dynamics.

Conversely, small and marginal maize farmers could bear a disproportionate share of adjustment pressures if local demand weakens. Domestic traders, regional feed processors and associated rural service providers — transporters, warehouse operators, commission agents and labourers — form part of a broader ecosystem linked to maize cultivation. Gradual shifts in sourcing patterns could affect this interconnected rural economy.

These concerns do not imply that imports will inevitably destabilize markets. Rather, they underscore the importance of monitoring and policy responsiveness.

The Regulatory and Precedent Dimension

India has historically adopted a cautious approach toward commercial genetically modified food crops. While DDGS is a processed residue and not a seed, its origin from predominantly GM maize introduces a regulatory nuance. Some stakeholders view this development as a potential shift in precedent, even if indirect.

Agricultural policy is shaped not only by scientific assessments but also by public trust and consistency. Transparent biosafety evaluation, clear documentation of origin and open public communication can help maintain confidence. Once trade pathways are established, they often evolve, making early safeguards particularly important.

India also occupies a distinct position in certain export markets as a supplier of non-GM agricultural products. Preserving clarity around this identity may carry long-term strategic value. In that sense, the DDGS decision intersects with broader considerations of trade positioning and agricultural branding.

Balancing Feed Efficiency and Farmer Welfare

The needs of the poultry, dairy and aquaculture sectors are legitimate. Feed efficiency contributes to food affordability and nutritional security. However, agricultural policy works best when it carefully balances industrial competitiveness with farmer welfare.

If concessional imports proceed, they could be accompanied by defined safeguards — such as mandatory testing of consignments, full chain-of-custody documentation, disclosure requirements for feed mills and periodic policy reviews involving farmer representation. A clearly defined trial period with transparent evaluation metrics may also enhance accountability.

Parallel investment in domestic capacity offers another constructive pathway. Strengthening India’s ethanol industry and encouraging indigenous production of feed co-products would allow the country to meet rising feed demand while retaining value addition within domestic supply chains. Supporting innovation in non-GM feed alternatives could further reinforce resilience.

A Question of Calibration

The DDGS import decision may appear numerically small, yet its economic and symbolic dimensions are meaningful. Trade engagement is a natural component of a modern economy. The broader question is how such engagement is calibrated to protect those who may face adjustment costs.

Maize farmers are central participants in India’s agricultural landscape. Ensuring that short-term feed cost considerations do not unintentionally weaken long-term farmer resilience is a shared responsibility. Agricultural policy, ultimately, is measured not only in tonnes and percentages, but in the stability of livelihoods and the confidence of rural communities.

About the author: Dr. Mamtamayi Priyadarshini is an environmentalist, social worker and author of Maize Mandate. She has written extensively on agricultural sustainability, seed sovereignty and the intersections of food and fuel policy in India.

19, Feb 2026

Build Connect 2026 Highlights Industry Shift Toward a Next-Gen Dealer–Distributor Network

New Delhi, Feb 19 – As India’s steel production crosses 160 million tonnes and installed capacity moves toward 300 million tonnes by 2030, the industry’s growth narrative is entering a new phase. While capacity expansion remains strong, the focus is increasingly shifting to a critical pillar of the value chain — India’s dealer and distributor network.

With nearly 50 million tonnes of finished steel in FY26 flowing through trade-led channels, dealers and distributors now account for a significant share of market movement. As steel demand is projected to rise steadily in the coming years, industry leaders note that distribution capability, financial resilience, and digital readiness will determine how effectively this growth translates into market reach.

This industry-wide conversation took centre stage at Build Connect 2026, held on February 19–20 at Yashobhoomi, New Delhi. The platform was organised by BigMint, a commodity market intelligence firm, in association with the Akhil Bhartiya Loha Vyapar Sangh (ABLVS) as Supporting Association. The event recorded over 1,500 footfall, including 500+ confirmed participants and 1,000+ registered visitors, representing 400+ companies across 72 cities and 15+ states. Nearly 48% of attendees were senior decision-makers, including Directors, Managing Directors, and business owners.

The platform also saw participation from SAIL as Strategic PSU Partner, alongside institutional and industry support from the AIIFA Sustainable Steel Manufacturers Association, National Institute of Secondary Steel Technology (NISST), Bureau Veritas, and prominent trade and construction organisations including BAI, GISF, CFI, RISTA, and BIMA — reflecting broad alignment across manufacturing, trade bodies, and technical institutions.

The inaugural ceremony featured senior industry figures including Shri V. R. Sharma (Member Advisory Board, Jindal Steel & Power), Shri Bimlendra Jha (Ex-MD, JSP & Ambuja Cements Ltd.), Mr. Anurag Sinha (Executive Director, Engineers India Limited), Mr. Vishesh Shahra (Chairman, Shreeyam Power & Steel Industries Ltd.), Mr. Vivek Adukia (Chairman, SRMA), and Mr. Amit Gupta (President, ABLVS).

Across 12 focused sessions and 40+ expert addresses, discussions spanned infrastructure demand, GST compliance, green steel adoption, supply chain finance, digital transformation, e-commerce integration, quality standards, branding impact, and payment recovery mechanisms. A recurring industry view emerged: expanding production capacity must be complemented by a more structured and financially empowered distribution ecosystem.

The Build Connect Awards 2026 recognised excellence across India’s steel distribution landscape, honouring regional distributor leadership, dealer performance, and technology adoption.

As India’s steel demand moves toward higher consumption levels, industry stakeholders reinforced that sustainable sectoral growth will depend not only on manufacturing scale but on building a stronger, more organised, and next-generation dealer–distributor backbone. Build Connect 2026 reflected that shift in focus — from capacity expansion alone to ecosystem strengthening across the value chain.