9, Oct 2024

RBI Holds Repo Rate Steady at 6.5% Amid Mixed Economic Signals

9th Oct 2024: The Reserve Bank of India (RBI) has decided to maintain the repo rate at 6.5%, marking a continuation of its current monetary policy stance. This decision comes amid mixed economic signals, with inflation showing signs of moderation but still remaining above the central bank’s comfort zone. The RBI aims to strike a balance between fostering economic growth and controlling inflation, recognizing the potential impact of external factors such as global economic conditions and geopolitical tensions.

By holding the repo rate steady, the RBI hopes to provide stability to the financial markets and support ongoing recovery in key sectors like manufacturing and services. Analysts suggest that the decision reflects the central bank’s cautious approach, allowing for a careful assessment of economic indicators before considering any adjustments. As businesses and consumers navigate this environment, the RBI’s commitment to monitoring inflation trends and growth prospects remains critical in shaping India’s economic landscape.

Anuj Puri, Chairman – ANAROCK Group

With the fundamentals of the Indian economy remaining strong despite global headwinds, geopolitical tensions and inflation well within control, the RBI has once again decided to keep the repo rates unchanged at 6.5% – thus helping the housing market to maintain momentum during the festive season. While a repo rate cut would have been preferable, it is clear that the RBI is on a tightrope walk and must keep various macro-economic factors in mind.

From the point of view of homebuyers, the relatively affordable home loan interest rate regime will continue at a critical time for the Indian housing market – the festive season – amid rising housing prices and tapered sales. Q3 2024 saw average housing prices rise by a cumulative 23% in the top 7 cities even as average prices in these markets collectively rose to approx. INR 8,390 per sq. ft. by Q3 2024-end, from approx. INR 6,800 per sq. ft. in Q3 2023.

Housing sales also declined to an extent in Q3 2024, even as prices rose. As per ANAROCK data, Q3 2024 saw residential sales go down by 11% annually against Q3 2023. New launches also fell by 19% in this period.

The unchanged home loan rates are much-needed demand support in the ongoing festive quarter. We are expecting faster sales momentum in Q4 2024 when compared to the preceding quarter. This year’s festive quarter may see similar demand to that seen in this period a year ago, if not higher. Over 1.27 lakh units were sold across the top 7 cities back in Q4 2023. Unchanged interest rates will play and important role in achieving and maintaining this momentum.

Mr. Pradeep Aggarwal, Founder & Chairman, Signature Global (India) Ltd

The RBI’s decision to hold rates steady aligns with expectations, to keep inflation under check. While the recent rate cut by the US Federal Reserve has sparked similar hopes in India, the domestic situation remains distinct, with the central bank prioritizing inflation management within its target range. Yet policy stability bodes well in the ongoing festive season which promises to be a significant phase in terms of real estate demand as the industry is hopeful of the continued rise in residential sales. As and when a rate cut is anticipated soon, which, when implemented, will benefit both homebuyers and real estate developers to capitalize on the market and strengthen overall economic growth.

Mr. Mohit Jain, Managing Director, Krisumi Corporation

The apex bank’s stance to keep the rates unchanged for the tenth consecutive time is on the expected lines. While the real estate industry was hoping for an interest rate reduction, a status quo is the next best outcome for the industry. Stable rates ensure consistent EMIs, giving homebuyers the confidence to plan their purchases. Furthermore, the expectation of potential rate cuts in the coming months is also boosting optimism in the real estate market and we expect the robustness in demand to continue over the next few years.

Mr. Pankaj Kalra, CEO, Essar Oil & Gas Exploration & Production Ltd (EOGEPL)

“The RBI’s decision to keep the interest rate steady at 6.5% reflects a measured response to current inflationary concerns. This decision provides a stable economic environment that is vital for planning and investing in long-term project financing and capital allocation. The decision to uphold the ‘Withdrawal of Accommodation’ stance aligns with our expectations and supports economic stability, ensuring that we can continue our exploration and production activities without the added uncertainty of fluctuating borrowing costs. At EOGEPL, we will use this stable interest rate to promote growth and help strengthen India’s energy sector.”

Dr. Esha Khanna, Assistant Professor at Sarla Anil Modi School of Economics, NMIMS

MPC’s adjustment in monetary policy to neutral is much needed and exhibits a balanced outlook on inflation and growth. Revised upward growth forecasts, downward adjustments of headline inflation toward the target, sufficient liquidity conditions, diminished volatility in the rupee, and robust external demand are several positive factors. Moving forward, decisions regarding rate cuts will be contingent on changing inflation dynamics, as core inflation has increased. There is a considerable risk related to food and metals, with uncertainty arising from volatile global factors, as highlighted in today’s policy statement. The RBI may postpone a rate cut by an additional quarter if upside risk to inflation continues, though real policy rates currently hover around 2 percent. Despite high real policy rates, Investment demand is at a decadal high, indicating that investment is propelled by robust economic demand and favorable production conditions owing by a gradual reduction in inflation rather than by alterations in interest rates. Overall, the shift in stance to neutral has created opportunities for a rate cut in the near future, which is expected to affect bond yields and likely result in a bullish market in the short term.

However, a subtle reminder to non-banking financial companies (NBFCs) to thoroughly assess their exposures in unsecured segments was essential, as NBFCs play a crucial role in financing MSMEs and have experienced significant growth in rural, small-scale, and unbanked sectors. These cover the varied financial requirements of the Indian economy, propelled by growth in lending, credit, and vehicle financing. Consequently, non-banking financial companies (NBFCs) must exercise greater caution as they experience larger balance sheets and an influx of public funds.

Mr. Arsh Mogre, Economist Institutional Equities, PL Capital – Prabhudas Lilladher

“The RBI’s Monetary Policy Committee held the repo rate steady at 6.5% for the tenth consecutive meeting, reflecting a cautious, data-driven approach amidst a global easing trend. Shifting to a ‘neutral’ stance indicates flexibility but not readiness for immediate easing. Governor Das’s firm message is clear: any rate cut will be contingent on achieving a durable alignment of inflation to the 4% target—a critical threshold that remains elusive amid persistent food price volatility and global uncertainties. The RBI’s inflation forecast for FY25 was kept at 4.5%, but the upward revision in Q3 to 4.8% signals rising caution over the impact of erratic monsoon patterns and geopolitical tensions. While strong Kharif sowing and high reservoir levels provide some relief, risks from La Niña and potential global supply shocks keep the inflation outlook precarious.

On growth, the RBI’s FY25 GDP projection remains robust at 7.2%, supported by resilient private consumption and investment, though early signs of moderation are evident in manufacturing and credit activity. This ‘neutral’ stance is not a precursor to rate cuts but a strategic recalibration which is “a calculated wait-and-see approach”, allowing the central bank to act swiftly if inflationary or growth dynamics shift sharply. Future cuts will likely be shallow (50-75 bps in FY25, starting from the Dec-24 meeting if growth indicators continue to show weakness), reinforcing that every policy decision remains ‘live’ and meticulously data-driven. The RBI’s stance is a clear signal: stability over stimulus, ensuring inflation is durably anchored before committing to a looser policy.”

Manish Chowdhury, Head of Research, StoxBox

An unexpected change in monetary policy stance from “Withdrawal of Accommodation” to “Neutral” has provided leeway to the RBI for a rate cut going ahead. However, we believe that a December rate would hinge upon multiple factors aligning including the trajectory of food inflation, the global economic and monetary policy setting and major commodity prices including crude oil and metal. With high frequency indicators showing signs of fatigue recently, we believe that the upcoming festive season would be a crucial factor in deciding the possibility of any downward revision to economic growth forecast. Though the central bank has tried hard to downplay an early rate cut expectation, our sense is that a rate cut in Q4FY25 is on cards, with the probability of the event happening in December looking evenly balanced.

Vaibhav Shah, Fund Manager,Torus Oro PMS

In line with expectations, MPC kept the interest rates unchanged at 6.5%. However with the change in stance to Neutral from Withdrawal of accommodation, we believe that the MPC has set the base for rate cuts either in December or early next year, as inflation seems to be on a continuous downward trajectory. The projections related to inflation and growth have not been altered significantly, leading on confidence on achieving the inflation path without any disrupting growth engine. MPC had a mention of cooling food prices which were the key volatile variable in the overall food inflation equation, which should help achieve the overall inflation target.

Mr Ashwin Chadha, CEO, India Sotheby’s International Realty

We were more hopeful of a rate cut this time around, after moves by the U.S. Federal Reserve and other central banks. But the RBI’s decision to hold the repo rate steady for the 10th time in a row shows that India is laser-focused on its own economic landscape, rather than following global cues.

One standout from the Monetary Policy Committee’s (MPC) meeting is the shift to a neutral stance, which suggests they’re open to more flexibility. While inflation is on a downward trend, it’s still not entirely stable, and the MPC is aiming for that 4% sweet spot.

A rate cut is certainly on the cards if inflation keeps cooling off, which looks promising in the near term.

For real estate, this steady approach is a win. With stable interest rates, homebuyers, especially during the festive season, will feel more confident in making their purchase decisions.

Mr Vimal Nadar, Head of Research, Colliers India

While RBI has kept the benchmark lending rates unchanged at 6.5%, a change in stance from “withdrawal of accommodation” to “neutral” indicates its clear direction for a possible reduction in interest rates in the foreseeable future. This ongoing stability in repo rate should provide a significant thrust to residential real estate during these festive months as home loan interest rates are likely to remain steady.

Typically, Q4, marked by higher inclination of homebuyers to wrap-up property purchases during the auspicious period combined with instantaneous liquidity benefit aided by developers offering attractive discounts, has historically provided the final push to housing sales across the major markets in the country. Additionally, steady borrowing costs and recent extension of Input Tax Credit (ITC) by the Supreme Court can potentially benefit property developers engaged in construction of commercial office buildings.

Nishant Srivastava CEO of Torus Wealth

Decision to maintain the repo rate at 6.50% aligns with expectations and demonstrates a continued focus on managing inflation. While neutral stance suggests a cautious approach to future monetary policy. Given the ongoing geopolitical tensions and global economic uncertainties, the RBI’s decision to prioritize inflation control is prudent. Its important to monitor economic indicators closely to assess the impact of this policy on growth and development.

Gurmit Singh Arora, National President, Indian Plumbing Association

In the RBI’s policy review on June 8, 2023, it was decided once again to keep the [repurchase] policy rate stable at 6.5% and the bottle is one available option after the 9th hike justification. It is the economy which is performing on many indicators but struggling on inflation to give room to the other idea. By going for a neutral stance they dispense with the necessity or the ability to undertake any policy action even in the future, it is more flexible. Though this stability in rates provides some breath to the present borrowers especially the schul creditors, this is a far shot from the sort of demand which an easing in the rates could have provided especially to the real estate space. The stable forecast on the GDP growth and inflation rates for FY25 still entails the possibility of India’s growth recovery over the medium-term based on prudent assumptions. However, the concern regarding the swelling enthusiasm in the property market that was sought before the holiday season might remain unfulfilled. Barring those two strategies, it seems homebuyers and of course new home owners will have to contend with this moderate rate environment either by way of new market innovations or cash inducements and adjusted value proportions in order to spark actions in real estate sales and purchase transactions.

Anurag Goel, Director at Goel Ganga Developments

In this case, there was nothing particularly surprising in what RBI Governor Das said regarding the repo rate remaining unchanged at 6.5%. Especially considering the RBI, Das said that in the environment of uncertainty existing at the time. This shift towards neutral posture is somewhat soft speaking, it’s a preparatory change it makes for easing policy. This decision, while keeping the status Quo of EMIs, vertically disadvantages the real estate sector.

On the one hand, it offers a stable environment in which planning and investment may be conducted over the long term. On the other, it deprived the market of the increased demand which a rate cut could have delivered during the all-important festive period. There is no change in GDP and inflation estimates for FY25, indicating faith in the do-nothing policy. However, volumetric parameters in strategy may need to be revisited by property market stakeholders as interest rate cut policies are likely to be absent.

LC Mittal, Director, Motia Group

The RBI’s decision to keep the repo rate unchanged for the tenth time at 6.5% is acknowledged to be a reasonable move under the current circumstances given high inflationary tendencies. The shift to a neutral stance signals the RBI’s commitment to aligning inflation with growth, ensuring that the market conditions remain favorable for sectors like real estate. As for the lack of a hinge to echo any change in borrowing rates, we perceive home loan EMIs currently to remain steady, which would, in turn, positively impact demand in the housing market.

Aman Gupta, Director, RPS Group

The RBI’s neutral stance after a prolonged period of holding the repo rate at 6.5% indicates a cautious yet optimistic approach towards managing inflation and growth. In addition, while this decision reduces volatility in borrowing rates which are of concern to real estate contractors and individuals, it also calls for budgeting because the threat of inflation still exists. We believe this move will help maintain confidence in the housing sector, but continuous vigilance is required to adapt to any shifts in the economic landscape.

Keshav Mangla, General Manager Business Development, Forteasia realty pvt ltd.

Like every other major financial institution in the world, the RBI has experienced criticism of its decision to keep the repo rate unchanged at 6.5%, the tenth such posture in a row, while easing the stance to neutral. Such policy directed at mitigating growth in the economy versus controlling inflation has its consequences on the real estate market. For instance, the result of stable interest rates may not necessarily be the most favorable for homebuyers and developers as it cuts off the advantage that comes with decline in interest rates. On the other hand, with the onset of the festive season which is characterized by a matter of fact annual surge in property sales, the sector is likely to have to offer additional cuts in pricing in order to stimulate sales. It is doubtful that given the unchanged GDP growth and inflation targeting for FY25, the RBI continues to view such a policy mix as appropriate for efficient growth of the economy. In any case, the audience of challenges in the real estate sector is however, a favorable environment that does not mean all the real estate industries equally benefit from such stability in the interest rates.

Ms. Rajani Sinha, Chief Economist, CareEdge Ratings on RBI Policy

“With the change in stance, the MPC has given itself the flexibility to cut rates going forward, depending on how the domestic and global conditions pan out for CPI inflation. While the RBI governor indicated the comfort provided by surplus monsoon and healthy Kharif harvest, he remained cautious of certain inflationary risks. Any adverse weather conditions, escalation of geo-political conflicts and the recent sharp increase in commodity prices needs to be monitored for future inflation trajectory.

We feel that there are chances of a shallow rate cut of 25 bps in the December policy, followed by another 25 bps in the March policy, provided food inflation moderates. While the Central Bank remains optimistic on growth, some moderation in recent high frequency economic indicators like core sector, PMI Manufacturing, GST collections, passenger car sales also give reason for the RBI to look at rate cuts going forward. Expectations of further rate cuts by major global Central Banks including US Federal Reserve is also supportive of a rate cut by RBI.”

Ms. Madhavi Arora, Lead Economist, Emkay Global Financial Services

RBI strikes a balance

The policy decision this time around wasn’t easy, and was indeed tricky for the RBI to find a balance in its policy biases with so many moving pieces. The MPC had a lot to process on domestic and external front:

(i) Incipient weakness in growth indicators,

(ii) Demand-led core disinflationary impulse despite noisy food dynamics, but a still-elusive 4% inflation target;

(iii) Comfortable banking liquidity, easy financial conditions on net;

(iv) The fluidity of global narratives with global fears of re-ignition of ‘high for long’ scenario, amidst Fed’s massive 50bp cut in Sep;

(v) Geo-political stress and upcoming US election event risk which could materially disturb Asian FX dynamics, amid ratcheting up of US-China trade war.

Thus, no rate action, in conjunction with stance change to neutral with stress on being ‘actively disinflationary’ is indeed their best bet to prep ground for start of a shallow easing cycle, possibly but not necessarily from December.

✓ The Gsec market has rejoiced the stance change and this, in conjunction with announcement of FTSE EMBI inclusion, has led to a 7-8bps rally in 10-yr yield from yesterday’s levels. The Repo-10yr spread has now compressed to 25bps.

Mr. Aman Sarin, Director & Chief Executive Officer, Anant Raj Limited

The RBI’s decision to keep the repo rate unchanged was expected, considering ongoing inflation concerns and global geopolitical uncertainties. However, with each MPC meeting, the likelihood of a rate cut increases, and we could see one in the coming reviews if current improvements continue.

Currently, home loan interest rates hover around 9.25%, a level that remains manageable for many borrowers. Also, given the stable rates for over two years, real estate demand has consistently grown, fueled by rising incomes, lifestyle upgrades, and economic growth. We are already seeing strong demand this festive season, which is likely to continue, regardless of any changes in interest rates.

Mr. Raoul Kapoor, Co-CEO, Andromeda Sales and Distribution Pvt Ltd

The RBI’s decision to keep the repo rate unchanged wasn’t a surprise, though many expected a rate cut, which could have boosted retail loan demand during the festive season.

However, lending institutions are stepping up with festive offers. For example, SBI is offering car loans starting at 9.05% interest with zero processing fees, providing borrowers with significant savings. HDFC Bank has launched its “Festive Treats” campaign, with car loans starting from 9.40% interest and up to 100% financing on select models, along with special cashback and down payment discounts.

These offers are aimed at capitalizing on the festive demand and helping customers secure better deals.

Rajiv Agrawal, Co-Founder, Saarathi Realtors

The RBI has once again decided to hold the repo rate for the tenth consecutive time. It brings cheers among the homebuyers as the relatively affordable home loan interest rate regime will continue during the festive season. This means if you have already applied for a home loan your EMI burden will not go up for the next couple of months. The RBI move will give a much needed relief to the realty sector as the festive spirit has gripped the industry.

Certified Financial Planner, Lt. Col. Rochak Bakshi (Retd.), Founder and CEO of True North Financial Services

Given the recent food inflation volatility and the escalation in the Middle East crisis, I expected the RBI to remain cautious and consider a rate cut only in the December meeting. While the 10 year bond has reacted by the yield falling by 7bps to 6.74%, the inflation related data going ahead will decide the future course of action. As of now, it’s only a wait and watch mode for both the bond and equity markets after the immediate fall in the 10 year bond rates.

Samir Jasuja, Founder & CEO, PropEquity

The property market has exhibited consistent growth despite stable interest rates. The property market looks buoyant and both homes sales and launches will get a festive push to stabilise the total number at 2024 levels after experiencing a record high 2023. A rate cut would only add to this buoyancy.

Sanju Bhadana, MD, 4S Developers

In view of the ongoing geo-political tensions in the Middle East and the fear of food and oil inflation inching up, the RBI’s move to maintain status quo on interest rate is prudent. While growth and inflation projections are broadly in lines with RBI’s estimates, the global political and economic developments could play out in the coming quarters on India’s growth and inflation.

Shiwang Suraj, founder and director of Gurugram-based property consulting firm InfraMantra

We expected a slight cut in repo rate considering the fact that property sales and launches have been slowing down over the last three quarters of 2024. Amid global uncertainties and fear of growth slowing down and inflation going up, a rate cut would have been an ideal scenario to boost the property market.

VS Realtors (I) Pvt Ltd founder and CEO Vijay Harsh Jha

A rate cut would have helped in reducing interest on home loans thereby increasing homebuyers’ participation in the property market. This would have given a boost to the already flagging housing sales and launches during the festive season.

Saurav Ghosh, Co-founder, Jiraaf

“Clearly the Monetary Policy Committee is cautious about its movement. The current inflation drop is being attributed to positive base effects. Therefore, the RBI seems to be taking a wait-and-watch approach to carefully monitor the trajectory of inflation and then move the needle in the right direction. It’s likely that before the next financial year, the RBI will decide to cut the interest rates.”

Nikunj Agarwal, CFO and Head of Lending Alliance, Propelld

“The RBI’s decision to hold the repo rate at 6.5% and shift to a neutral stance brings stability to the lending sector. With no immediate hikes in lending costs, institutions can continue providing affordable loans. This also offers directional optimism for a potential rate reduction regime in the near future. However, the neutral outlook signals cautious monitoring of inflation, which could influence future rates, making this period crucial for expanding access to credit while watching economic trends closely.”

Rahul Jain – CFO, NTT DATA Payment Services India

“Increase in per transaction limit to Rs 10,000 from Rs 5,000 under UPI 123 and enhanced limits in UPI Lite is a big positive. Under-served categories such as senior citizens, and users from rural India with limited usage of digital means may find this beneficial. Enhanced limits can be particularly useful to make utility bill payments and for payments to other users.

This welcome move from the RBI comes after the SEBI’s directive to allow UPI based block mechanism for funding secondary market trades in the capital market. Overall, the use-cases for UPI are increasing. This augurs well for both the consumer as well as for the industry, as payments become more efficient and convenient.”

Mr. Gaurav Garg, Research Analyst, Lemonn Markets Desk

“The RBI’s shift to a neutral stance, is in line with our expectations, and indicates readiness for potential rate cuts, possibly starting in December, depending on incoming data. Overall, we believe MPC acted in a prudent way to balance the domestic growth priorities with global uncertainties like rising crude prices and geopolitical tensions. RBI appears to be comfortable with the growth outlook for H2 FY25 while remaining confident on the last mile disinflation process. As such, we expect any rate cut cycle to be shallow – may be limited to two 25bps rate cuts in the H2 FY25, possibly starting from December.

From markets perspective, Equities had reacted positively after the decision of stance change with rate sensitive realty and banking stocks seeing gains while benchmark yields moved lower.”

Manish Jain, director – institutional business (equity & fi) division at mirae asset capital markets views on RBI MPC.

RBI turned to be slightly dovish Little twist in quarterly numbers due to unfavorable quarter (extended monsoon and elections this year). But overall maintained annual estimates with improvement in 2nd half of year which is estimated to continue till next fiscal. Upcoming indicator prints will be unfavorable but the above average rainfall (will support agricultural growth), rising manufacturing activities, improving rural/ urban demand and rebounding investments will drive the growth. MPC highlighted concerns on the NBFC sector on unsecured loan segments; could expect slowdown in bank credit growth going forward Globally growth is resilient. Major central banks have started easing cycles and improving global trade will aid growth. Risks/ uncertainties from manufacturing slowdown, geopolitical escalations, adverse weather and US elections persist. Possible rate cuts in upcoming meetings. Continuation of inflation downward trend, strength in core sector growth and contained geo-political escalations will support the possible RBI pivotal.

- 0

- By Rabindra

9, Oct 2024

Zhejiang Medical Manufacturing Enters South Asian Market

The 2024 Zhejiang International Trade (India) Exhibition, it started from October 5th and will be going on till 7th October at the Pragati Maidan Convention and Exhibition Center in New Delhi. The main event, the 39th MEDICALL exhibition, is recognized as the premier medical trade show in India and South Asia. It attracted medical manufacturers and providers from countries such as Germany, the United States, Japan, South Korea, and Italy.

The three-day exhibition featured a dedicated Zhejiang area with 70 booths, showcasing 41 companies from cities including Hangzhou, Wenzhou, Jinhua, Yiwu, Shaoxing, Taizhou, Jiaxing, and Huzhou. Exhibits spanned a wide range of products, including medical devices, consumables, in vitro diagnostics, disinfectants, protective equipment, rehabilitation care, traditional medicine, home healthcare, as well as the latest innovations in smart healthcare and medical industry services.

Prominent companies such as Zhejiang Orient Gene Biotech Co., Ltd., Hangzhou Clongene Biotech Co., Ltd., MDK, and Zhejiang Haisheng Medical Device Co., Ltd. showcased their cutting-edge products and technology, highlighting the quality and competitiveness of Zhejiang’s medical manufacturing industry and reinforcing the “Made in Zhejiang” brand image.

Throughout the exhibition, international buyers, distributors, agents, import-export traders, pharmacies, and rehabilitation centers gathered in the Zhejiang exhibition area for trade discussions, negotiations, and potential collaborations.

India’s economy has experienced continued growth in recent years, with significant government investment in healthcare infrastructure. The Indian healthcare market is poised for further expansion, and India ranked among the top ten export destinations for Chinese medical device companies in the first half of 2024. Leveraging its core technological advantages, Zhejiang’s medical and healthcare sector is accelerating its expansion into South Asia. This exhibition provided a valuable platform for Zhejiang enterprises to connect with potential customers, partners, and industry experts in the Indian and broader South Asian markets. It also enabled them to stay abreast of market trends and customer needs, enhancing their competitiveness in India’s medical and healthcare industry.

9, Oct 2024

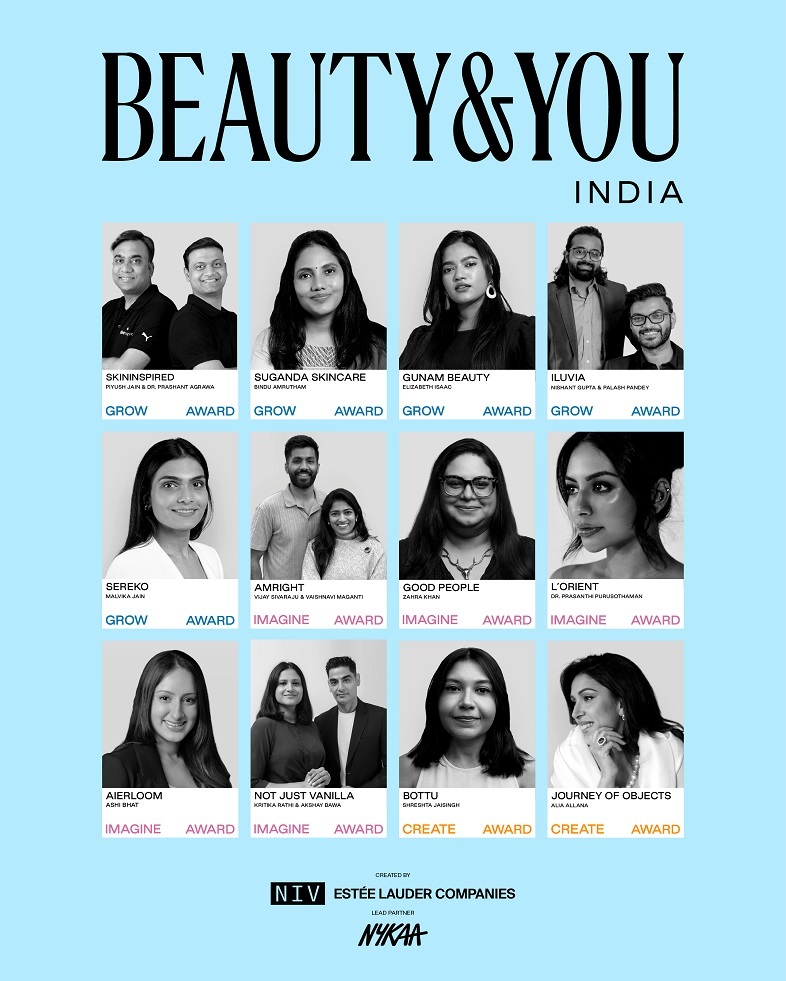

The Estée Lauder Companies’ NIV and NYKAA Announce The BEAUTY&YOU India 2024 Finalists

The twelve finalists represented a cross-section of the Indian beauty industry’s most promising new talent

October 9th, 2024: The Estée Lauder Companies (“ELC”) New Incubation Ventures (“NIV”), and NYKAA are pleased to announce the finalists for BEAUTY&YOU India 2024. Created by NIV and launched in partnership with India’s leading beauty and lifestyle retailer, NYKAA, BEAUTY&YOU India continues its mission to discover, spotlight, and propel the next generation of India-focused beauty brands. The 2024 program builds on the success of previous years with the theme of Supercharged Futures.

This year, the program saw over 660 applicants double the amount from when the program launched in 2022. Applicants are from over 50 cities representing all beauty categories. From these applicants, NIV and NYKAA executives selected 12 finalists in the three categories of GROW (in-market), IMAGINE (pre-launch), and CREATE (storytellers). This year’s applicants were highly focused on breakthrough innovation via product technology and platforms, patented systems as well as identifying new market segments and consumer segments.

“BEAUTY&YOU India continues to reflect our deep commitment to nurturing and empowering India’s most promising beauty entrepreneurs,” said Shana Randhava, Senior Vice President, of New Incubation Ventures, The Estée Lauder Companies. “As one of the world’s most dynamic and rapidly expanding beauty markets, India holds a vital position in the global landscape. India’s potential is immense, and this program underscores our belief in the creativity and entrepreneurial spirit driving its beauty sector. Each edition of BEAUTY&YOU India has demonstrated remarkable progress, and the 2024 program builds on this momentum. We are excited to further elevate the India beauty story and support the next generation of beauty innovators who will shape the future of this industry.”

GROW (In-Market Companies)

iluvia

Nishant Gupta and Palash Pandey Co-Founders

Iluvia’s scientifically backed products target Indian consumers living in metropolitan areas looking for an effective solution for hard water-induced hair issues, including hair loss, flaky scalp, and premature graying.

Instagram: @iluviapro

Gunam Beauty Elizabeth Issac Founder

Translating to “goodness” in founder Elizabeth Isaac’s native Malayali language, Gunam’s skin care and supplements merge Indian ingredients with French formulating expertise.

Instagram: @gunambeauty

SkinInspired Piyush Jain Founder & CEO

Dr Prashant Agrawal Founder and CPO

Skin Inspired is a science-backed skin care company that uses multi-active ingredients that deliver results and innovative packaging that makes for a seamless user experience.

Instagram: @skininspired.in

SEREKO

Malvika Jain Founder

Sereko breaks the loop of recurring skin issues with its patent-pending psychodermatology formulas that early clinical results suggest reverse the signs of stress in skin.

Instagram: @sereko.official

Suganda Skincare Bindu Amrutham Founder

Suganda was born from founder Bindu Amrutham’s personal quest for safe and effective solutions for the skin that holistically balance scientific innovation with gentle care.

Instagram: @suganda.co

IMAGINE (Pre-Market Concepts)

NOT Just VANILLA

Akshay Bawa Founder and CEO Kritika Rathi Founder and CMO

Not Just Vanilla redefines body care with targeted, results-driven solutions for overlooked areas, empowering consumers to feel confident and embrace self-love every day.

Instagram: @notjustvanilla.co

GOOD PEOPLE

Zahra Khan Founder

With a goal to do more with less, Good People’s clinically vetted skin care simplifies routines and delivers strong results.

Instagram: @goodpeoplestudio.co

Amright Vaishnavi Maganti Founder

Vijay Sivaraju Co-Founder

Amright combines clinically proven Swiss ingredients with genetic research on hair to promote female hair regrowth, offering custom solutions to fullness.

Instagram: @amrightindia

Aierloom Ashi Bhat Founder

Aierloom introduces world-first, patent-pending waterless shampoo and conditioner gels that blend Ayurvedic wisdom with Australian innovation. Zero-waste beauty essentials, with zero compromises to efficacy or experience.

Instagram: @aierloom.in

L’ORIENT

Dr. Prasanthi Purosothaman Founder/CEO

Revolutionary holistic hyperpigmentation care merging heritage with innovation, L’Orient’s biotech- derived Ayurvedic botanicals combine with cosmeceuticals within novel delivery and microbiome enhancing formulas to help address the skin exposome.

Instagram: @lorientofficial

CREATE (Creative Storytellers)

Journey of Objects Alia Allana

Founder & Journalist

Seamlessly blending reportage and retail, Journey of Objects is an e-commerce marketplace that helps embrace sustainability and preserve the cultural diversity of India through industry research and thoughtful product curation.

Instagram: @journeyofobjects

Bottu

Shreshta Jaisingh Founder

Bottu is a modern face applique brand that is reimagining the bindi for the digital age. Instagram: @bottubeauty

On October 17th, finalists will pitch their start-ups to the esteemed jury, which includes Tarun Tahiliani, Founder and Director, Tarun Tahiliani; Anaita Shroff Adajania, Stylist, Creative Director & Founder, Style Cell; Shruti Chandra, Vice President, Invest India; and Samrath Bedi, Executive Director, Forest Essentials. Winners will be announced at a special event the same evening at The Leela Palace, New Delhi.

An exciting addition to this year’s program is that winners have access to the BEAUTY&YOU India Bootcamp, featuring one-on-one mentorship sessions with industry leaders Falguni Nayar, Founder & Chief Executive Officer, NYKAA; Sabyasachi Mukherjee, Founder, Sabyasachi; and Rohan Vaziralli, General Manager, ELCA Cosmetics Private Limited. This unique opportunity is designed to provide the winners with invaluable insights and mentorship from these experts and affirms the program’s commitment to fostering the growth and development of the next generation of Indian-focused beauty entrepreneurs. BEAUTY&YOU India 2024 will provide award recipients with financial support via a prize pool of up to 4 Crore, or $500k, distribution channel access, mentorship, and access to research and innovation resources.

“Our partnership with BEAUTY&YOU India continues to play a vital role in identifying and empowering the next generation of India-focused beauty brands. With India’s beauty industry growing at an unprecedented pace, now is the perfect time to support the innovators and creators shaping its future. At Nykaa, we believe in the potential of homegrown talent, and through BEAUTY&YOU, we are committed to providing the platform, mentorship, and resources needed to thrive. As we celebrate the success of the 2024 program, we are committed to sustaining this momentum and further supporting India’s dynamic beauty ecosystem, with a vision of fostering a future where Indian brands take the lead on the global stage,” said Anchit Nayar, Executive Director & CEO, NYKAA Beauty.

9, Oct 2024

IndoSpace commits to increasing investments upto INR. 4500 crores in TN over the next three years

October 9, 2024 : IndoSpace, India’s largest investor, developer, and operator of Grade A industrial and logistics real estate, today announced plans to increase its investments up to INR 4,500 crore in new logistics and warehouse parks in Tamil Nadu. Following an INR 2000 crores MOU with the Tamil Nadu government last year, this new announcement highlights the firm’s dedication to both the state and the Make in India initiative. These parks will support the growing manufacturing sectors like automobile and electronics in the state.

Significantly, this investment is expected to create 8000 + new jobs, accelerating economic growth and enhancing the state’s already credible industrial infrastructure.

Tamil Nadu continues to be a preferred destination for global Original Equipment Manufacturers (OEMs), with companies like Hyundai, Nissan, Foxconn, and Pegatron announcing significant expansions in the state. IndoSpace has helped in developing an ancillary ecosystem that supports these OEMs, facilitating seamless supply chain operations and enabling faster industrial growth. The company’s strategic parks, located across key industrial zones, have provided state-of-the-art infrastructure to industries, contributing significantly to Tamil Nadu’s growing prominence as a global manufacturing hub.

IndoSpace’s presence in Tamil Nadu: With a portfolio comprising 15 Grade A parks, IndoSpace has developed over 8.8 million square feet of completed infrastructure, with an additional 2 million square feet under construction and 4.6 million square feet planned for future development. These parks are spread across 649 acres of land and serve 66 unique tenants from a variety of sectors, including automotive, electronics, logistics, and engineering. IndoSpace’s total equity committed to the state as on date stands at USD 380 million, and the facilities offer a potential chargeable area of 15.4 million square feet, reinforcing IndoSpace’s strong presence in Tamil Nadu’s industrial ecosystem.

IndoSpace industrial and logistics park have supported Tamil Nadu’s ‘Make in India’ and ‘Make in Tamil Nadu’ initiatives through Plug-n-Play manufacturing solutions. These customizable, ready-to-use facilities have enabled businesses to set up operations quickly, thereby reducing time to market and enhancing manufacturing efficiency.

“Tamil Nadu’s industrial landscape has seen remarkable growth, and IndoSpace is proud to have played a key role in this transformation. Our ongoing investments, including a recently signed MoU with the Tamil Nadu Government, demonstrate our strong belief in the state’s potential as a global manufacturing powerhouse. Through innovative infrastructure solutions such as Plug n Play manufacturing facilities and customized industrial spaces, we are helping businesses thrive while also driving the state’s economic development. IndoSpace remains fully committed to supporting Tamil Nadu’s and thereby the larger national vision for industrial advancement and job creation,” said Mr. Rajesh Jaggi, Vice Chairman, Real Estate, The Everstone Group.

9, Oct 2024

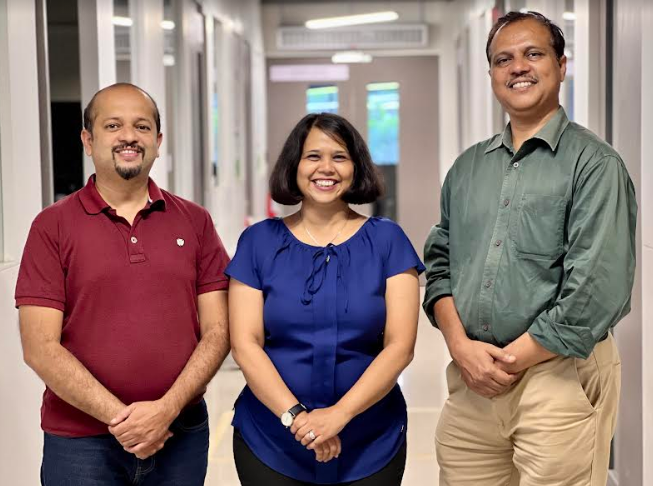

BioPrime Closes Dollar6 Million in Funding to Advance Development of Biologicals for Sustainable Agriculture

National 09 Oct 2024: BioPrime, a pioneer in the biologicals space, announced today that it has raised a $6 million Series A round, led by Edaphon, with equal participation from existing investors Omnivore and Inflexor. This investment marks Belgium-based Edaphon’s first investment in Asia. This investment will fuel BioPrime’s research in the crop protection segment, focusing on the co-development of novel biofungicides & bioinsecticides.

The company plans to launch its existing range of innovative biostimulants in North America, Brazil & Southeast Asia with trials in the US currently underway. Furthermore, BioPrime plans to advance & accelerate product development based on BioNexus, the patented technology platform, which has identified over 170 novel microbial strains from its library of close to 18,000 strains. BioPrime will continue to steadily move away from a one-product-fits-all approach and enhance B2B customer experience by offering products customized to the exact customer needs. The startup’s goal remains – From Nature, For Nature.

Dr. Renuka Diwan, Co-founder & CEO, commented on the funding, “Securing this investment is a testimony to the strength & impact of our technology and the dedication of our team. We will continue to pursue our strategic priorities of accelerating the development of industry solutions in the biologicals space. We look forward to enhancing the offerings to our existing B2B customers & entering into strategic co-development & licensing with industry players.”

BioPrime was founded in 2016 by Dr. Renuka Diwan, Dr. Amit Shinde, and Dr. Shekhar Bhosale. The founders bring together a wealth of knowledge & expertise in plant and microbe biotechnology with patents in targeted secondary metabolite production & animal feed. Since 2016, the company has experienced remarkable growth, expanding its workforce by 10X, tripling its product offerings, and evolving from a presence in just two states to establishing a strong footprint not only across India but also expanding in Southeast Asia and US. In under a decade, BioPrime has emerged as the preferred biologicals R&D partner for agrochemical companies and other farmer facing agri companies.

“We invested in BioPrime because of its impressive balance between a strong portfolio of commercial products and a high-potential innovation pipeline. The company has already demonstrated success in delivering impactful solutions to the market, while its advanced R&D platform is set to unlock significant future growth. Operating within India’s rapidly growing biostimulant market, BioPrime is deeply connected to the country’s agricultural core, providing crucial solutions to smallholder farmers and addressing sustainability challenges. This combination of proven market performance, forward-looking innovation, and strong market potential makes BioPrime well-positioned to drive both immediate and long-term impact” says Vincent Vliebergh, Managing Partner of Edaphon

“The current round of investment further strengthens the growth path being charted by BioPrime leveraging its IP and consumer product portfolio. It also further deepens the conviction on the biologicals space in India,” quoted Pratip Mazumdar, Managing Partner of Inflexor.

“The climate crisis threatens the very future of agrifood systems and rural communities across India. The complex web of challenges threatening food security and rural livelihoods demands innovative approaches with potential for systemic change,” says Jinesh Shah, Managing Partner of Omnivore. “Our investment in BioPrime underscores our steadfast commitment to advancing sustainable farming practices.”

9, Oct 2024

AIR INDIA’s New Inflight Entertainment Wins Top Honors at 2024 World Travel Awards

GURUGRAM, 08 October 2024: Air India, India’s leading global airline, has been awarded the coveted title of Asia’s Leading Airline Inflight Entertainment 2024 at the prestigious World Travel Awards (WTA) held this year in Manila. This is the first time that an Indian airline has won this title.

World Travel Awards, often referred to as the “Oscars of the travel industry,” serves to acknowledge, reward, and celebrate excellence across all sectors of the global travel and tourism industry. In its 31st annual edition, the awards spotlighted excellence worldwide. With this recognition Air India has now joined an elite club of global airlines which have won the award in previous years.

“This award is a testimony of Air India’s commitment to providing our customers with the best inflight entertainment experience. It reaffirms our commitment to the ongoing transformation of Air India into a world-class airline,” said Rajesh Dogra, Chief Customer Experience Officer, Air India.

The award recognises the full suite of Inflight Entertainment (IFE) content curated by Air India and is available on the airline’s Airbus A350s presently serving the Delhi-Heathrow route and which will commence to New York (JFK) in November. The same offering will be featured on the 64 new widebody aircraft on firm order, as well as the legacy widebody aircraft as they undergo full interior retrofit of seats and entertainment systems.

The full suite of the new IFE content features over 3000 hours of entertainment content across formats and genres, including 1400 hours of movies, 850 hours of TV, and 1000 hours of audio, for today’s discerning travellers.

The largest library of Indian content in the skies: Air India guests can choose from over 300 Indian movies spanning decades and genres. The new content catalogue offers a rich spectrum of regional cinema with 120 Indian regional movies in eight languages, in addition to a host of popular and engaging web series and digital content.

Hollywood blockbusters: The Hollywood collection caters to all tastes, offering close to 300 Hollywood movies, including BAFTA and Oscar-winning titles.

International favourites: Air India’s global cinematic repertoire spans 13 languages, including French, Spanish, German, Mandarin, Cantonese, Indonesian, Japanese, Korean, Portuguese and Slovenian, among others, featuring critically acclaimed films from around the world.

TV and digital content: Air India’s in-flight library boasts 1400+ episodes of Western, Indian and International TV shows and digital content, spanning an array of genres and categories. Guests can enjoy content from ‘behind-the-wall’ as Air India’s new IFE will feature a selection from the biggest streaming and OTT platforms, including Paramount+, HBO, Sony Liv, Hulu, etc as well as an extensive library of content from Vogue, GQ, The New Yorker.

Audio: RJs Malishka Mendonsa, Ginnie Mahajan, Salil Acharya, Archana Pania, Anuraag Pandey, and more offer an exclusive auditory journey on Air India Radio, as they bring celebrity interviews, artiste specials, trivia, and music. Don’t miss Cup O’ Tales, an Air India special-edition podcast series featuring Ayaz Memon, along with a diverse range of other audio podcasts. Dive into our extraordinary music collection, offering over 1200 choices, including 190+ curated playlists, and an expansive album collection that spans genres and eras, from Pop and Rock to Jazz, Western Classical, Bollywood, Ghazals, Hindustani & Carnatic Classical, Indipop, Indian Regional, Relaxation and much more.

Kids Zone: Young flyers can enjoy an extensive selection of over 100 hours of curated audio and video content, divided into three dedicated sections: Pre-School, Kids, and Teens.

9, Oct 2024

Analog Devices Unveils CodeFusion Studio and Developer Portal to Accelerate Intelligent Edge Development

India, October 9, 2024 – Analog Devices, Inc., a global semiconductor leader, today launched a suite of developer-centric offerings that unite cross-device, cross- market hardware, software and services to help customers deliver innovations for the Intelligent Edge with enhanced speed and security. Central to this launch is CodeFusion Studio™, a new, comprehensive embedded software development environment based on Microsoft’s Visual Studio code. This environment is ADI’s first-ever fully integrated suite of software and security solutions. CodeFusion Studio™ leverages a modern integrated development environment (IDE) and command-line interface, which incorporates open-source configuration and profiling tools to simplify development on heterogeneous processors and drive efficiencies.

CodeFusion Studio™ is available today for download on ADI’s new Developer Portal (developer.analog.com) – a comprehensive resource hub, offering extensive documentation, support, partnerships and community engagement. CodeFusion Studio™ also supports the ADI Assure™ Trusted Edge Security Architecture, the company’s universal hardware and software security foundation, which provides a simple and flexible way to natively implement security in Intelligent Edge devices. Together, CodeFusion Studio™, ADI Assure™ and the ADI Developer portal provide customers with the tools and resources they need to help bring products to market more quickly with enhanced security and reliability. By accelerating deployment times, customers can quickly capitalize on the full value of the Intelligent Edge, which can lead to better business decisions, improved customer satisfaction, enhanced insights and overall business growth.

“The complexity of embedded development at the edge is growing, demanding expertise in hardware, software, and security simultaneously,” said Gregory Bryant, president of Global Business Units at ADI. “We believe we are uniquely positioned to provide deep expertise in integration and vertical technologies across diverse markets, making innovation faster, easier and more cost-effective. That’s why we are investing heavily in developing and launching these solutions, with plans to continue, enabling our customers to confidently innovate for the Intelligent Edge.

9, Oct 2024

Sterling and Wilson Data Centers Teams Up with Maerifa Solutions to Harness AI in Key Markets

Mumbai, India, October 9, 2024: Sterling and Wilson Private Limited, India’s leading engineering, procurement, and construction (EPC) companies, today announced a strategic collaboration with Maerifa Solutions, a leading digital infrastructure company focused on the provision of technology design and deployment and supply chain management. This tie-up marks a significant step in providing enhanced data center and infrastructure solutions for investors and businesses globally.

This partnership will allow Sterling and Wilson to explore opportunities to provide full turn-key data center infrastructure including server technology to its customers, offering competitive pricing and high-quality service. Maerifa Solutions has developed a rich ecosystem covering Nvidia, Intel, SuperMicro, Stelia and Quantum Switch amongst others, including financing parties for the active equipment assets. The collaboration will also aim to explore new bespoke digital infrastructure projects, including a significant opportunity to be at the forefront of Artificial Intelligence projects in Africa.

Commenting on the development, Mr. Prasanna Sarambale, CEO, Sterling and Wilson Data Center Business said, “With this partnership, we want to expand our reach to tap regions which need robust, high performance, scalable and AI ready datacenter infrastructure that can efficiently manage the massive growth of data being witnessed today. This milestone underscores the commitment of both Sterling and Wilson and Maerifa Solutions, to adopting innovation and addressing the growing global demand for advanced digital infrastructure. We are certain that together we will develop tailored solutions for the stakeholders and drive exponential growth across the digital landscape.”

Commenting on the development, Mr. Mitesh Gupta, Non-Executive Chairman, Maerifa Solutions said, “Partnering with Sterling and Wilson continues our commitment to work with only the best-in-class companies worldwide and we share a combined desire to lead with ‘knowledge’ and a ‘customer-first’ approach to this rapidly growing sector. This exciting partnership will ensure that together we are able to meet the growing demands from our customers for datacenter infrastructure to support their AI growth ambitions. We look forward to working with the Sterling and Wilson team to shape the ecosystem moving forward in particular in emerging markets, with a focus on delivering value for all of our stakeholders.”

Sterling and Wilson commenced Data Centre services in 2015, and in a short span of time, it has emerged as one of India’s leading Data Centre EPC players in the sector. It has executed 25 DC projects with total IT load of more than 65MW, in India and international markets, with leading Colocation and Hyperscale organizations. We are currently executing 5MW in Kingdom of Saudi Arabia, 1.5MW in Luanda, Angola-West Africa, 6MW for a COLO player & 96MW for a Hyperscaler player in India.

Maerifa Solutions was conceived, incubated and launched by Aethlius Holdings to create an ecosystem of Tier-1 partners across Digital Infrastructure and related financing solutions to address the funding gap of acquiring hard-to-access GPU server technology. Since its launch in Q3 2024 it has already partnered with leading players in the industry and is in discussions to deliver multi-million dollars’ worth of hardware and associated solutions to projects in Europe, Middle East, Africa and Southeast Asia.

9, Oct 2024

KLH Hyderabad Hosts Fests Showcasing Techno-Management Excellence and Cultural Vibrancy

New Delhi, October 2024: KLH Hyderabad Campus celebrated the successful conclusion of AVINYA 2024, the much-anticipated annual techno-cultural fest at its Aziz Nagar campus. This much-anticipated two-day event celebrated the intersection of technology and culture, bringing together students, innovators, and artists for a vibrant showcase of talent and creativity.

The day one events were buzzed with technology-focused competitions like the IQ Quiz, Dataalchemy, Scavenger Hunt, and Chatterbot, offering participants thrilling intellectual challenges. The Project Expo showcased innovation, with AceCoder by B Tech students including Sweshik Reddy and Lucky Kumar winning the software category for their advanced coding solution, and Flask-based Application for Face Recognition by G. Siddartha and Rohan taking second place for its emphasis on security. In hardware, the Autonomous Self-Driving Car by Lakshmi, Meghana, and Nousheen attained the top prize, while the Anti-Theft Flooring System by students G. Nandini, K. Harshitha, M. Amruta, K. Nagarani, and M. Manogna secured second place, both showcasing real-world applications and technical creativity.

On day two, the campus turned into a cultural carnival with dance, music, and a DJ night, offering participants a stage for artistic expression. The presence of popular actors Shafi and Kiran Abbavaram, along with the team from the movie Kallu Compound, actor Gowtham and more brought cinematic flair to the festivities. Distinguished guests included Chief Guest Sri Murali Bommineni and Guest of Honor Ms. Shanthala, Head of Partner Relations and Communications at WE Hub (an initiative of the Government of Telangana), whose participation inspired all in attendance.

Parallelly, the KLH Bachupally campus hosted NOVUS, welcoming the fresh academic year with enthusiasm, featuring games, a cultural extravaganza with student performances, and special appearances by actor Nara Rohith, Akshar Band, and the cast of ‘Committee Kurrollu.

Dr. G. Pardha Saradhi Varma, Vice Chancellor, KL Deemed to be University reflected on the event, stating, “The enthusiasm and innovative spirit displayed across all our campuses highlight the integral role such events play in enhancing the holistic educational experience. We are proud to provide platforms that not only demonstrate the technical and creative talents of our students but also promote cultural exchanges that enrich their learning and personal growth.”

Dr. A. Ramakrishna, Principal, KLH Aziz Nagar campus, Dr. L Koteswararao, Principal, KLH Bachupally Campus, senior management officials along with event convenors, faculty members, staff and students ensured smooth conduct of the events. The University keeps organizing such events to encourage students’ participation and engagement for holistic development and learning.

9, Oct 2024

AMTP 2024: Raising the Bar in the Amusement Industry

The Annual Meet & Training Program (AMTP) 2024 concluded with great success, making a lasting impact on the Indian Amusement Industry. Held in the vibrant city of Lucknow, this year’s event was themed “Raise the Bar” and attracted a record-breaking 170 participants, setting new standards for collaboration and innovation within the industry.

Shri Mukesh Kumar Meshram, IAS, Principal Secretary Tourism & Culture, Government of Uttar Pradesh was the Chief Guest and delivered the keynote addresses in which he presented state tourism policy and opportunities of investments in the state.

Lucknow, renowned for its rich cultural heritage and warm hospitality, proved to be an ideal host for AMTP 2024. The city’s unique blend of tradition and modernity provided an inspiring setting for industry leaders and professionals to engage in thought-provoking discussions, in-depth brainstorming sessions, and intensive training on a variety of contemporary topics. From leadership development to artificial intelligence, legal compliance, people management, branding, and enhancing retail presence, the program was designed to equip attendees with the necessary tools and insights to thrive in today’s dynamic market.

The event featured a series of compelling sessions led by industry experts:

• Mr. Vikas Jain, a renowned leadership coach, kicked off the event with his session on “Exponential Leadership,” highlighting the critical role of visionary leadership in driving growth and innovation within the amusement industry.

• Dr. Arunabha Mukhopadhyay from IIM Lucknow explored the potential of “Leveraging Technology & AI in Amusement,” demonstrating how artificial intelligence can revolutionize operations and enhance customer experiences.

• Mr. Rajan Bhalla, a seasoned brand strategist, presented on “Multi-Generational Marketing,” offering actionable strategies to appeal to diverse age groups and ensure long-term brand loyalty.

• Prof. Nishant Uppal of IIM Lucknow delivered a thought-provoking session on “People Management,” using airline industry analogies to illustrate the importance of maintaining a strong organizational culture.

• Adv. Brijesh Kumar Singh provided crucial insights into “Legal & Compliance,” helping participants navigate the complex regulatory landscape and avoid potential legal pitfalls.

• Flt. Anand Lamdhade and Dr. Kishore Dogra emphasized the importance of “Operational Safety,” focusing on robust safety protocols and risk management strategies essential for amusement operations.

• Mr. Dhruva Paknikar from Dominix Group captivated the audience with his session on “Brand Recall through Merchandise,” explaining how strategic merchandising can significantly boost brand visibility and customer loyalty.

AMTP 2024 also featured two highly anticipated panel discussions:

• The first, on “Opportunities & Challenges in the Amusement Industry,” was moderated by Mr. Jai Malpani from Imagica. The panel included prominent industry leaders such as Mr. Sesha Kanthamraju, CEO of Ramoji Film City, Mr. Rajesh Raisinghani, MD & CEO of Nicco Parks, Mr. Darpan Shah, Director of Arihant Industrial Corporation, and Mr. Rohit Mathur, MD of CSML. The discussion delved into the evolving landscape of the amusement industry, offering insights into the vast opportunities for growth as well as the challenges that need to be addressed.

• The second panel focused on the “Indoor Amusement Center – Raise the Bar” theme and was moderated by Mr. Rajeev Jalnapurkar. This discussion included panelists such as Mr. Ankur Maheshwary, Founder of Masti Zone, Mr. Prashant Kanoria, Founder of Puttaput, Mr. Bhavesh Shah, Founder of Gujarat Amusement, and Mr. Pankaj Agarwal, Founder of Puno. The conversation centered around innovative approaches to enhancing the indoor amusement experience, emphasizing the importance of raising standards within this growing segment.

The final day of the program included site visits to Blue World Park in Kanpur and Anandi Magic World in Lucknow. These visits provided participants with a firsthand look at successful amusement park operations, state-of-the-art attractions, and the latest advancements in amusement technology.

AMTP 2024 was more than just an event; it was a convergence of ideas, innovation, and leadership, setting a new benchmark for the amusement industry. The knowledge gained and connections made during these three days will undoubtedly propel the industry forward, continuing to “Raise the Bar.” Lucknow’s charm, rich cultural tapestry, and welcoming atmosphere added a unique flavor to the event, making it a memorable experience for all who attended and highlighting the city’s growing importance as a hub for industry gatherings.