11, Feb 2026

Balrampur Chini Mills Limited Announces Q3 & 9M FY26 Financial Results

Balrampur Chini Mills Limited has announced its financial results for the third quarter and nine months ended December 31, 2025.

Strong Operational Performance in Q3 FY26

BCML delivered a healthy performance during the quarter, reporting improved distillery volumes and better realizations in the sugar segment.

Commenting on the results, Mr. Vivek Saraogi, Chairman and Managing Director, Balrampur Chini Mills Limited, said:

“During the quarter, the sugar segment delivered strong performance, driven by improved realizations despite the increase in SAP of sugarcane from Rs. 370 per quintal to Rs. 400 per quintal, which led to higher production costs.

The distillery segment delivered stable performance driven by higher volumes. However, the absence of revision in ethanol prices resulted in a decline in margins.

Sugarcane crushing during the quarter was approximately 8.4% higher at 387.6 lakh quintals owing to the early start of a few plants and better capacity utilization. Gross sugar recovery (C-heavy terms) improved marginally by 8 basis points to 10.63%. Despite a decline in sugarcane area, crushing for the Company is expected to be higher due to additional area allotted by the State Government.”

India’s net sugar production (post diversion to ethanol) is estimated at 28.8 MMT, up approximately 10.3% from 26.1 MMT in the previous season. The Government has announced an export quota of 1.5 MMT for the season. Considering domestic consumption and exports at 29.2 MMT, closing stock is expected to be around 4.6 MMT as on September 30, 2026, indicating a drawdown from last year’s opening inventory of 5 MMT.

On the policy front, concerns regarding ethanol imports from the US for blending have eased following the trade deal. However, the pending revision in domestic ethanol prices continues to remain an overhang. Despite a significant increase of approximately 16.4% in sugarcane FRP and operational costs, ethanol prices under the Juice and B-Heavy routes have not been revised since ESY 2022-23. The Company emphasized t

- 0

- By Neel Achary

11, Feb 2026

Odysse Electric Strengthens Leadership; Appoints Industry Veteran Sudhir Goel as Co-founder

New Delhi; Feb 11: Odysse Electric Vehicles Pvt. Ltd., one of India’s fastest-growing premium electric two-wheeler manufacturers, today announced a significant evolution in its leadership structure with the appointment of Sudhir Goel as Co-founder. This strategic move underscores the company’s transition into a more robust, professionally run organisation designed to capture the next phase of growth in the Indian EV revolution and green mobility.

By bringing aboard Mr. Goel, a seasoned leader with over 28 years of experience spanning in the automotive, engineering, and electric vehicle sectors, the company aims to institutionalize its operations and drive sustainable, long-term value for stakeholders. Mr. Goel is a proven strategist, business leader and has successfully scaled ventures from inception to profitability and launched breakthrough products in electric mobility. His distinguished career includes leadership roles at Ford Motor Company in Japan, Jay Ace Technologies (a JP Minda Group company) as CEO, and Greenfuel Energy Solutions as President – Lithium Batteries, followed by his work as an independent consultant guiding EV companies in scaling their operations.

The appointment of Sudhir Goel as Co-Founder emphasizes Odysse Electric’s commitment to building a corporate structure that balances entrepreneurial agility with world-class professional management. In his new role, Mr. Goel will focus on Operational Excellence – streamlining supply chain and manufacturing processes to meet the growing demand and Strategic Expansion – strengthening Odysse Electric’s retail footprint.

Nemin Vora, Founder & CEO, Odysse Electric Vehicles said,

“Odysse Electric is no longer just new startup; we are a significant player in the national mobility conversation. The appointment of Sudhir Goel as Co-Founder is a testament to our evolution. His professional pedigree and track record will provide the structural backbone we need to drive long-term growth.”

On his appointment, Sudhir Goel, stated,

“I am excited to join Odysse at this pivotal stage. The company has built a strong foundation with innovative products and a clear vision. I look forward to leveraging my experience to scale operations, strengthen the EV ecosystem, and drive Odysse towards becoming a significant player in the sustainable mobility revolution.”

With the expansion of the leadership team, Nemin Vora, Founder and CEO of Odysse Electric, will continue to lead the brand’s vision and product development in close association with co-founder Sudhir Goel. This strategic leadership enhancement positions Odysse to solidify its market presence, optimize its supply chain, and explore new avenues for growth, reinforcing its commitment to sustainable and innovative mobility solutions.

11, Feb 2026

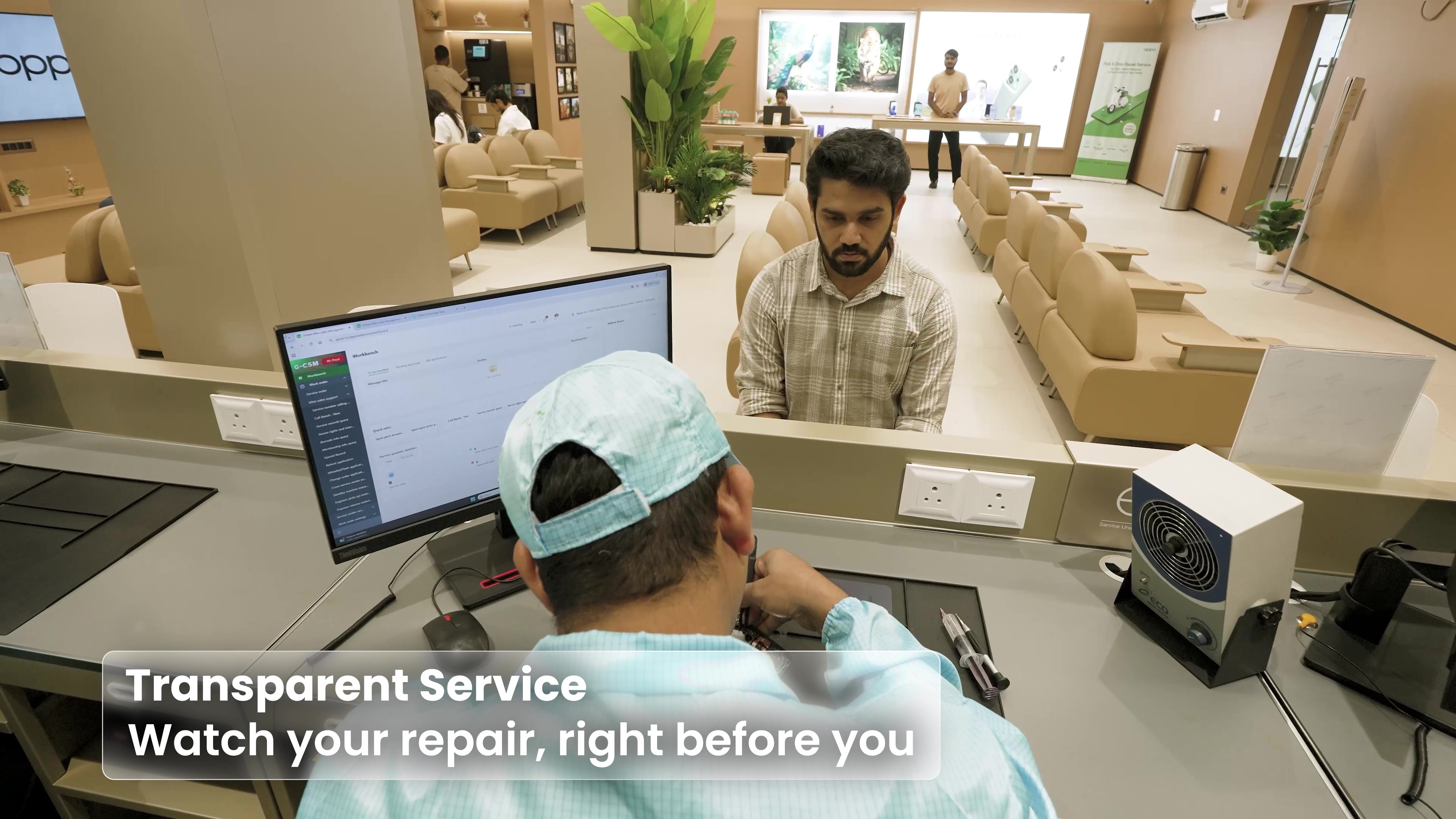

OPPO India elevates after-sales experience with Service Center 3.0 Pro

New Delhi, Feb 11: Reaffirming its commitment to customer-centric innovation, OPPO India today announced the introduction of Service Center 3.0 Pro, the next generation after-sales network designed to further enrich the ownership experience for today’s modern-day users. With 29 premium centres already operational, OPPO aims to bring 110 new centers across India in 2026.

Going beyond conventional repair and support, Service Center 3.0 Pro delivers a hassle-free service experience that prioritises comfort, transparency, and operational efficiency. The upgraded format integrates digital check-in and real-time queue updates to reduce wait times, supported by dynamic digital signage that provides continuous, clear communication throughout the visit. Customers also benefit from face-to-face repair and servicing for their devices, ensuring clarity, authenticity, and a more informed service interaction.

The new centres feature a refreshed visual identity that creates a cleaner, more welcoming first impression. The layout has been streamlined with clearly defined service zones and comfortable lounge areas for easy navigation. Smarter use of space introduces multi-purpose work points to improve efficiency without compromising comfort. The centres also include a dedicated product experience zone, allowing users to explore devices hands-on, along with a gaming zone to make waiting more enjoyable. These centers are already operational across 18 states including Gujarat, Maharashtra, West Bengal, Delhi NCR, Kerala, and other key markets, with expansion continuing nationwide.

Commenting on the launch, Mr. Goldee Patnaik, Head of Communications, OPPO India, said:

“Customer expectations continue to guide how we evolve our service strategy at OPPO India. With a nationwide network of service centers, we stay closely connected to what our users need from after-sales support. Their message has been consistent: service must be faster, more transparent and supported by simple, technology-led processes. These next-generation centers are built for modern-day users who value efficiency, clarity and a consistent premium experience across touchpoints. As we scale this upgraded format across the country, our focus remains the same—every improvement starts with what our customers tell us.”

OPPO continues to strengthen its consumer commitment through a robust network of over 570+ service centers across 500+ cities, offering support in 19 languages. Free pick-up and drop for repairs, along with a 24-hour turnaround time, remain key pillars of OPPO’s service promise, reinforcing its dedication to a seamless and premium after-sales experience. These initiatives ensure minimal downtime, delivering fast, reliable, and hassle-free support to users nationwide.

Technology-Led Efficiency, Human-Centric Care

Aligned with the Government of India’s Right to Repair initiative, OPPO India provides a Self-Help Assistant accessible via social media platforms (X, Facebook, Instagram), YouTube, website videos, and the MyOPPO App, enabling users to troubleshoot independently.

Support also includes AI-powered chatbots, IVR voice bots, and a multilingual hotline in nine languages—Hindi, English, Tamil, Telugu, Bengali, Marathi, Gujarati, Malayalam, and Kannada—operating from 9 AM to 10 PM daily, including public holidays.

Find and Reno users enjoy priority support through Premium Queue registration. Service benchmarks include a six-hour email turnaround time, a two-hour social media response time, 92% of calls answered within 20 seconds, and 97% of chats responded to within 20 seconds.

Building Relationships Beyond Repairs

OPPO India strengthens long-term ownership value through service-led engagement. Service Days are celebrated from the 10th to 12th of every month, offering free refreshments, phone cleaning, software updates, screen guards, phone back covers, and attractive repair discounts.

Find and Reno series users receive additional benefits, including complimentary phone covers and screen guards twice a year. Customers can also opt for OPPO Care Protection Plans, available with select new device offers or for separate purchase, covering one-time screen replacement, extended warranty, and protection against accidental and liquid damage.

11, Feb 2026

Vietjet Unveils Holi & Spring Offers for Indian Flyers with Free Baggage and Festive Dining

Vietjet rolls out Holi & Spring travel offers for Indian flyers with free checked baggage and special festive inflight dining

Mumbai, Feb 11: Vietjet is rolling out special spring travel offers for Indian passengers planning a quick international getaway around the Holi holiday period, including free 20kg checked baggage for Eco ticket holders and a specially curated Vietnamese menu for Business Class travellers – adding extra value and flavour to trips to Vietnam this season.

Timed perfectly for Indian travellers looking to plan a Holi break or a short spring escape, the offer comes as outbound leisure travel demand continues to grow from India with Vietjet operating direct services from Delhi, Mumbai, Ahmedabad, Bengaluru and Hyderabad to Vietnam’s key gateways including Hanoi and Ho Chi Minh City, with convenient onward connections across Vietnam and the wider Asia-Pacific region.

Under this promotion, passengers booking Eco tickets on flights between India and Vietnam can enjoy complimentary 20kg checked baggage. The offer is valid for bookings made until February 28, 2026 via www.vietjetair.com and the Vietjet Air mobile app, for travel between February 10 and March 31, 2026 – an ideal window for Holi vacations and spring travel plans.

Adding further value for holidaymakers, Vietjet passengers can also enjoy up to 30% discounts on resort and lifestyle services, including stays, dining and spa packages, at select hotels and resorts in Phu Quoc Island, a fast-growing favourite among Indian beach travellers .

As part of the festive celebrations, Vietjet is also introducing a special Vietnamese Lunar New Year inflight menu available from February 10 to February 20, 2026, for Business Class passengers on selected domestic and international flights operating to and from Ho Chi Minh City and Hanoi.

Signature dishes include Steamed Pork Balls with Wood Ear Mushrooms, Braised Pork with Rice, Red Sticky Rice with Chicken Sausage, Hanoi-style Chicken Noodle Soup combo, Chicken and Bamboo Shoots Vermicelli, and Bitter Melon Soup with Fish Paste. Traditional desserts such as Lotus Seed sweet soup and Green rice sweet soup are also part of the menu.

Business Class passengers can enjoy Vietjet’s premium flying experience featuring priority services, curated cuisine, attentive cabin service, and modern, fuel-efficient aircraft.

With attractive travel benefits aligned to the Indian holiday calendar and growing connectivity between India and Vietnam, Vietjet continues to strengthen its position as a preferred airline for affordable, high-value international leisure travel while showcasing Vietnam’s rich cultural and culinary experiences.

11, Feb 2026

CDSL Hosts 3rd Reimagine Symposium; SEBI Chief Launches Amar Chitra Katha Investor Series

Mumbai, Feb 11: Central Depository Services (India) Limited (CDSL), Asia’s first listed depository and custodian of over 17.5 crore demat accounts, hosted the third edition of its annual symposium, “Reimagine: Securities Market through Data Synergy,” in Mumbai.

The event brought together policymakers, regulators, Market Infrastructure Institutions (MIIs), intermediaries, industry leaders, and technology innovators to deliberate on the evolving role of data in building future-ready securities markets. As part of the Reimagine platform, CDSL also announced the winners of the inaugural Reimagine Ideathon 2026, a nationwide competition inviting students to reimagine investor education for a Viksit Bharat.

Leadership Participation

The symposium was presided over by Shri Tuhin Kanta Pandey, Chairman, Securities and Exchange Board of India (SEBI), as Chief Guest. It was graced by Shri Sandip Pradhan, Whole-Time Member, SEBI, and Shri Keki Mistry, Former Vice Chairman & CEO, HDFC, as Guests of Honour, alongside eminent speakers and panelists from across the securities market ecosystem.

Addressing the gathering, Shri Tuhin Kanta Pandey, Chairman, SEBI, said:

“For decades, when we spoke of market infrastructure, we meant exchanges, clearing corporations, depositories etc. Today, there is another layer of infrastructure that is just as critical, though largely invisible — data. Data is the new plumbing of capital markets: unseen, indispensable, and powerful. In this world, the quality of data, the security around it, and the governance frameworks that guide its use matter as much as capital and liquidity themselves. I also commend CDSL for organising the Reimagine Ideathon challenge, which has encouraged students across the country to participate in our investor education and awareness mission.”

Focus on Data, Trust and Market Resilience

The symposium featured three thematic panel discussions centered on:

-

Data-driven innovation at scale

-

Trust as a cornerstone of market growth

-

Regulatory frameworks and cybersecurity preparedness

-

Organisational and cultural shifts required for a data-centric securities ecosystem

Setting the context, Shri Nehal Vora, Managing Director & CEO, CDSL, said:

“The Reimagine Symposium reflects CDSL’s commitment to encouraging collaborative dialogue across the securities market ecosystem. As markets evolve in an increasingly digital environment, leveraging data responsibly and securely will be key to strengthening investor confidence and building inclusive and resilient securities markets.”

Shri Sandip Pradhan, Whole-Time Member, SEBI, added:

“As India’s securities markets continue to deepen and broaden, the role of data-driven insights and investor education becomes increasingly critical. Strengthening investor awareness and encouraging responsible participation are essential to sustaining market integrity and investor confidence. Platforms such as Reimagine provide a valuable forum to drive innovation while reinforcing these foundational objectives.”

Shri Keki Mistry, Chair of the Reimagine Ideathon Jury, noted:

“Platforms like the Reimagine Symposium are important for shaping the conversation on the future of India’s securities market, particularly as data and technology become central to market infrastructure. The Ideathon added a refreshing dimension by engaging students and encouraging practical, implementable ideas.”

Shri Gurumoorthy Mahalingam, Chairperson and Public Interest Director, CDSL, emphasized:

“India’s capital markets are entering a phase where data, technology and governance must move in alignment. Channelising domestic savings into productive market-linked assets, while ensuring strong data governance and investor protection, will be critical to funding India’s long-term growth.”

Reimagine Ideathon 2026 Winners Announced

A key highlight of the symposium was the felicitation of winners of the Reimagine Ideathon 2026.

-

Project Sahayak from Goa Institute of Management emerged as the winner, receiving the top prize of ₹5 lakh.

-

Project Khet Nivesh from Shri Ramswaroop Memorial College, Lucknow, secured the first runner-up position with ₹3 lakh.

-

Project Nivi from BNM Institute of Technology, Bangalore, won the second runner-up prize of ₹2 lakh.

The competition attracted over 1,000 registrations from institutions across 21 states and 2 Union Territories, with a total prize pool of ₹12 lakh.

AI-Powered Panelist Debuts

In a first-of-its-kind initiative, the symposium featured an AI-powered panelist that participated alongside industry experts, offering real-time, data-driven insights on key themes. The initiative demonstrated the growing role of artificial intelligence in strengthening market intelligence and decision-making frameworks.

Launch of Amar Chitra Katha Investor Education Series

As part of CDSL’s broader investor education initiatives, SEBI Chairman Shri Tuhin Kanta Pandey launched CDSL Investor Protection Fund’s Amar Chitra Katha comic series in 12 languages at the symposium. The series aims to translate complex financial concepts into engaging, story-led narratives to promote informed investing across diverse audiences.

11, Feb 2026

Siemens Launches First Experience-Led Brand Store in Gurugram, Marks 100 Years of Oven Innovation

Gurugram, Feb 11: BSH Home Appliances Pvt. Ltd., a subsidiary of BSH Hausgeräte GmbH and a global leader in premium home appliances, has announced the launch of its first Siemens Brand Store in Gurugram, in partnership with Home Square Exzellenz Pvt. Ltd. Strategically located at DLF Phase 1—an address synonymous with premium living—the new experience-led store reinforces Siemens’ commitment to intelligent, design-driven, and future-ready home solutions for discerning homeowners.

The launch also aligns with a historic milestone for the brand. In 2026, Siemens celebrates 100 years of oven innovation, marking a century of redefining how the world cooks through engineering excellence and cutting-edge technology.

Strengthening Presence in a High-Growth Premium Market

The expansion underscores Siemens’ focused growth strategy in high-potential luxury markets. Gurugram has rapidly emerged as a hub for premium residences, modular kitchens, and intelligent homes, driven by rising disposable incomes, global lifestyle exposure, and increasing premiumisation.

India’s organised modular kitchen industry is projected to grow at a CAGR of 25% until 2030, supported by strong real estate momentum. Built-in appliances are playing a central role in shaping modern kitchen aesthetics. Post-pandemic, dishwasher adoption has witnessed a sharp uptick in urban markets such as Gurugram, with homeowners increasingly opting for integrated formats that deliver seamless, clutter-free designs—reflecting the city’s shift toward sophisticated, design-led living.

Design That Integrates Performance with Aesthetics

Siemens’ minimalist design philosophy—defined by clean geometry, intuitive interfaces, and seamless integration—has positioned the brand as a preferred partner for architects and interior designers shaping contemporary living spaces. Its appliances are engineered to balance powerful performance with understated elegance, allowing products to blend effortlessly into modern interiors while making a bold design statement.

Intelligent Innovation at the Core

Commenting on the launch, Saif Khan, MD & CEO, BSH Home Appliances India, said:

“Imagine an oven that recognises what you’re cooking and adapts itself to deliver exactly the result you love, or a coffee machine that remembers your perfect brew every single time. From AI-enabled ovens equipped with integrated cameras that detect up to 100 dishes, to coffee machines offering over 30 personalised beverage options and intelligent systems like i-Dos that measure detergent with absolute precision, Siemens innovations are designed to make everyday living smarter and simpler.

The launch of our Siemens flagship store in Gurugram brings this vision of intelligent, design-led living to life for consumers who value progress, performance and aesthetics. We are witnessing a strong and consistent rise in demand for premium cooking appliances and dishwashers in the region, reflecting Gurugram’s growing aspiration for integrated, high-quality and future-ready homes.”

A Fully Immersive Experience Centre

Designed as an interactive experience destination, the Siemens Brand Store – Home Square Exzellenz showcases the brand’s premium built-in and freestanding appliances through thoughtfully curated kitchen zones. Visitors can engage in live product demonstrations, explore personalised integrated kitchen planning solutions, and receive expert consultations for end-to-end kitchen transformations.

With over 25 retail touchpoints across Delhi NCR, including five in Gurugram, Siemens continues to strengthen its premium leadership in North India—catering to the growing demand for intelligent, integrated, and aesthetically refined home solutions.

10, Feb 2026

Valentine’s Day Special : Love, Served Warm With Saz

Feb 10 : This Valentine’s Day, Saz invites you to celebrate love in its purest form—through food that comforts, excites, and lingers long after the last bite.

Rooted in indulgence yet crafted with intention, Saz’s Valentine’s Day special menu is a reflection of love languages expressed on the plate. From bold, playful flavours to soft, familiar comforts, each dish is designed to be shared—or not—because love doesn’t always follow rules.

Whether it’s a Midnight Filo Affair, Roman Pillow Talk, or Chocolate Between the Sheets, the menu leans into pleasure, nostalgia, and unapologetic indulgence—because when food is made with feeling, it becomes more than a meal. It becomes a moment.

At Saz, love is layered, messy, warm, and deeply satisfying. And this Valentine’s Day, that’s exactly how it’s served.

Where: Saz, BKC

Date: 10th – 15th February

10, Feb 2026

Sattva Group Expands National Footprint with 8 Mn Sq Ft Urban Redevelopment in Mumbai

Mumbai, Feb 10: Sattva Group, one of India’s long-standing real estate developers, today announced its formal entry into the Mumbai Metropolitan Region (MMR) with six residential and commercial redevelopment projects spanning over 8 million sq ft of construction area. The projects, awarded through competitive evaluations, are located in Parel (Sewri), Prabhadevi, Goregaon East, Vile Parle West, Powai and the Bandra Kurla Complex (BKC) vicinity.

With these six projects, Sattva Group expects to deliver more than 2500 rehabilitation homes and over 2000 newly built residences. Construction across the portfolio will begin in 2026 and continue in phases until 2032, with the first project likely to be delivered by 2028. The total Gross Development Value (GDV) across the projects is estimated at approximately ₹11,000 crore.

The company’s entry comes at a time when Mumbai is undergoing an extensive cycle of structural renewal, with more than 16,000 ageing buildings requiring redevelopment to meet modern safety, planning and sustainability standards. Upcoming refinements to Development Control and Promotion Regulation (DCPR) 2034 are expected to further support redevelopment viability across Slum Rehabilitation Authority (SRA), Maharashtra Housing and Area Development Authority (MHADA) and society-led models, creating strong demand for technically capable and financially disciplined developers.

Sattva’s Mumbai portfolio has been shaped through a rigorous multi-parameter evaluation framework encompassing regulatory clarity, engineering feasibility, environmental responsibility, lifecycle asset performance and stakeholder engagement. Over the past year, the Group has built deep on-ground intelligence across key redevelopment micro-markets, enabling precise project phasing, design efficiency and an execution strategy aligned with local regulatory dynamics.

Speaking on the new development, Bijay Agarwal, Managing Director, Sattva Group, said,

“Mumbai is entering a defining phase of urban renewal, driven by the need to replace ageing structures with safer, well-planned, future-ready housing. Redevelopment requires clarity, discipline and long-term commitment, values central to Sattva’s growth over the past three decades. Our entry into Mumbai is a strategic extension of our legacy of delivering large, technically complex projects on time and with consistency. We look forward to contributing meaningfully to the city’s next decade of growth.”

In line with its redevelopment philosophy, Sattva Group’s Mumbai projects adopt a structured, rehabilitation-led approach centred on safety, transparency and long-term sustainability. Existing residents will receive upgraded amenities, enhanced safety systems and structured transition support, overseen by dedicated engagement teams across the redevelopment lifecycle.

Anchored in engineering-led design and governance-driven project management, the Group’s entry into Mumbai reflects a disciplined approach to complex urban redevelopment, with a focus on execution certainty and long-term asset integrity, supporting the renewal of ageing housing stock and Mumbai’s evolution into a safer, more resilient and future-ready city.

10, Feb 2026

Databricks Reaches Record Revenue Run-Rate, Secures Major Funding to Accelerate AI and Lakebase

Feb 10: Dat

This financing drew strong

Financial momentum

This investment follows

- Surpassing a $5.4 billion

revenue run-rate, growing >65% year-over-year. - Delivering positive free cash

flow over the last 12 months. - Crossing a $1.4 billion

revenue run rate for its AI products. - Sustaining a net retention

rate of>140%. - >800 customers consuming at

over $1 million annual revenue run-rate. - >70 customers consuming at

over $10 million annual revenue run-rate.

“We’re seeing overwhelming

investor interest in our next chapter as we go after two new markets,” said Ali Ghodsi, co-founder and CEO of Databricks. “With this new capital, we’ll double down on Lakebase so developers can create operational databases built for AI agents. At the same time, we’re investing in Genie to let every employee chat with their data, driving accurate and actionable insights.” “Databricks is a generational

company that has become a backbone for enterprise data and AI, helping organizations across critical sectors seize opportunities and overcome challenges,” said Todd Combs, Head of the Strategic Investment Group for JPMorganChase’s Security and Resiliency Initiative. “This initial investment reflects the strength of Databricks’ secure platform and continues to support their innovative, production‑scale applications that serve customers around the world.”

Building the future of Data +

The company will use the