25, Feb 2026

Excelsoft Cuts Infrastructure & Internet Costs with ‘Saras Assessments in a Box’

Feb 25: Excelsoft Technologies a global leader in digital learning and assessment solutions, today announced the launch of Saras Assessments in a Box, a compact, plug-and-play assessment appliance designed to enable secure digital examinations anywhere instantly.

Built using Saras Assessment, Excelsoft’s flagship platform, the device enables institutions to set up a fully functional, secure test centre in minutes, with or without internet connectivity. About the size of a matchbox, it eliminates the need for servers or complex IT infrastructure; users simply power it on, connect via Wi-Fi or LAN, and start delivering exams immediately. A single device supports 100+ concurrent candidates, ensuring high-performance exam delivery without bandwidth bottlenecks.

Speaking about the launch, Mr. Dhananjay Sudhanva, Chairman & Managing Director, Excelsoft Technologies, said,

“This marks a paradigm shift in how assessments are delivered. As examination scale increases and access expands, legacy, infrastructure-heavy models are proving inadequate. Saras Assessments in a Box fundamentally changes that equation by reducing the time and cost of setting up secure test centres while enabling a more resilient, inclusive, and reliable assessment experience for end users. Built on our Saras flagship assessment platform, it allows institutions to conduct exams consistently across diverse environments, including national and state-level entrance exams, university and college assessments, recruitment and certification programs, remote and rural initiatives, and temporary or emergency test centres.”

From a technology and architecture standpoint, the innovation reflects Excelsoft’s focus on building assessment systems designed for real-world conditions.

Speaking about the innovation, Mr. Adarsh Sudhindra, Chief Innovation Officer, Excelsoft Technologies, said,

“Assessment technology must be engineered for reliability at scale, not continuous connectivity. Saras Assessments in a Box introduces a distributed, appliance-led architecture that simplifies deployment while strengthening security and performance. By enabling exams to run locally yet remain centrally governed, institutions can conduct high-stakes assessments consistently across diverse environments without being constrained by infrastructure limitations. The solution is designed for a wide range of use cases, including national and state-level entrance examinations, university and college assessments, recruitment and certification programs, remote and rural assessment initiatives, corporate and skill-based testing, and temporary or emergency test centres.”

With this launch, Excelsoft Technologies continues to lead innovation in the assessment sector delivering solutions that simplify complexity, expand access, and enable secure, scalable, and resilient digital examinations anywhere in the world.

- 0

- By Neel Achary

25, Feb 2026

Vinkesh Gulati Joins BARS as Founding Member, Calls for Citizen-Led Road Safety Movement

New Delhi: Reinforcing the urgent need for a unified and citizen-driven approach to road safety in India, Mr. Vinkesh Gulati has joined as a Founding Member of the Bharat Association of Road Safety Volunteers (BARS) and will serve as Vice Chairperson and President – Corporate Affairs. He is currently serving as Chairperson of the Automotive Skills Development Council.

Announcing his association with BARS, Mr. Gulati emphasized that road safety is not merely a policy discussion but a national responsibility that demands collective action, accountability, and sustained collaboration. He described the initiative as a people’s movement aimed at bringing together diverse stakeholders under one unified platform to reduce fragmentation and accelerate meaningful impact on road safety outcomes.

The Bharat Association of Road Safety Volunteers (BARS) has been envisioned as a collaborative forum that connects volunteers, industry leaders, policymakers, civil society organizations, and community stakeholders who are working tirelessly to save lives on India’s roads. By fostering transparency, collaboration, and accountability, BARS seeks to strengthen coordination among all road safety partners and create a structured approach to awareness, advocacy, and action.

Speaking on the occasion, Mr. Gulati expressed his gratitude to the founders and mentors of BARS for their trust and for providing him the opportunity to contribute to what he termed a “transformative journey.” He reiterated that improving road safety requires long-term commitment, strong governance mechanisms, and active public participation. “Road safety in India must evolve into a mass movement. It is not just about enforcement or infrastructure—it is about shared responsibility. Through BARS, we aim to build a transparent and collaborative ecosystem that delivers measurable outcomes and ensures accountability at every level,” he said.

With India facing significant challenges related to road accidents and fatalities, initiatives like BARS are expected to play a critical role in aligning efforts across sectors and driving sustained behavioral change.

BARS stands on three core pillars – Transparency, Collaboration, and Accountability – serving as guiding principles for its mission to make Indian roads safer for every citizen.

Echoing the spirit of collective commitment, Mr. Gulati concluded with a strong message: “Together we can. Together we will.”

25, Feb 2026

TOKYO SKYTREE Elevates Cherry Blossom Season with “THE Sakura SKYTREE” Spring Experience

Tokyo, Feb 25: Tobu Tower Skytree Co., Ltd. has announced the return of its seasonal spring event, “THE Sakura SKYTREE® – Going to Meet the Cherry Blossoms Above the Clouds,” at TOKYO SKYTREE. The limited-period experience will run from February 26 to April 14, 2026, offering visitors a reimagined cherry blossom celebration 350 metres above Tokyo.

Positioned around the theme “Sky × Sakura,” the event transforms the Tembo Deck (Floors 350 and 340) into a curated spring environment featuring cherry blossom décor and Japanese-inspired photo installations. Designed to evoke the fleeting beauty of sakura, the installation pairs seasonal symbolism with panoramic skyline views, creating a distinctive alternative to traditional park hanami.

Immersive Projection at SKYTREE ROUND THEATER®

A major highlight for evening visitors will be a special seasonal presentation at SKYTREE ROUND THEATER on Floor 350. The observatory’s expansive windows will convert into a panoramic projection surface for a three-minute visual narrative capturing the quiet poetry and transience of cherry blossoms.

Powered by 24 projectors and immersive surround sound from 13 speakers, the presentation integrates culture, technology, and storytelling within one of Tokyo’s most iconic landmarks, adding a theatrical dimension to the spring viewing experience.

Limited-Edition Sakura Café Menu

Complementing the visual programming, the SKYTREE CAFE on Floor 350 will introduce a limited-edition cherry blossom-themed menu. Offerings include both alcoholic and non-alcoholic beverages, alongside spring-inspired sweets crafted to be visually striking and share-worthy.

Featured items include plant-based, vegan, and gluten-free donuts in “Sakura Mochi” and “Sakura Sky Vanilla” flavours. The menu aligns with growing demand for inclusive and aesthetically engaging culinary experiences at landmark attractions.

W1SH RIBBON Installation and Seasonal Illumination

Extending the spring theme, the W1SH RIBBON monument on the Tembo Deck will feature limited-edition pink ribbons throughout the event period. Visitors can tie their wishes against a softly illuminated pink installation symbolising renewal and new beginnings. The monument lighting will also transition to pink to ensure cohesive visual continuity across the deck.

On select evenings, TOKYO SKYTREE will be illuminated in a special spring lighting display titled “Sakura SKY (Sakura-Sora).” Inspired by cherry blossoms blooming against a vast spring sky, intersecting beams of soft pink light will symbolise petals dancing in the wind, transforming the tower into a seasonal beacon across Tokyo’s skyline.

A New Perspective on Hanami

With immersive décor, projection mapping, curated gastronomy, and city-scale illumination, “THE Sakura SKYTREE®” positions TOKYO SKYTREE as a compelling addition to Japan’s spring travel calendar. By blending tradition with contemporary presentation at 350 metres above ground, the event offers an atmospheric, accessible, and distinctly urban interpretation of cherry blossom season.

25, Feb 2026

When things have to be done quickly

Rail brakes support fast roller changes in laminating units

SAUERESSIG has evolved from being a manufacturer of printing and embossing rollers to becoming a highly innovative machine manufacturer with a diverse product range.

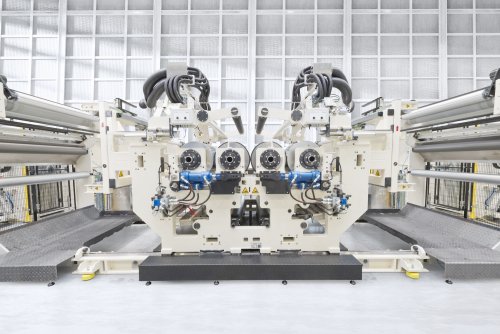

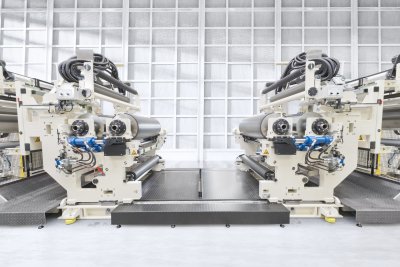

In a large laminating unit by SAUERESSIG Engineering for laminating steel strip on both sides, rubber rollers press a protective PET film onto hot steel strip. Despite cooling, these rubber rollers do wear down and need to be replaced regularly. Four profiled rail brakes by mayr® power transmission ensure that the laminating process, which takes place 24 hours a day, only has to be interrupted briefly to replace the rollers.

SAUERESSIG began manufacturing printing and embossing rollers for the packaging and printing industry around 70 years ago. Today, the company is a highly innovative mechanical engineering company with a diverse portfolio. As a leading full-range supplier of calendering, embossing and rotary processing systems in standard and special designs, the company supplies a wide range of industries.

The machine solutions include both complete production lines and customized systems for embossing, finishing, coating, smoothing, perforating and calibrating sheet materials such as paper, film or metal sheets. The company offers comprehensive expertise from the initial idea to the final customized solution, including planning and designing mechanics, drive and automation technology, pre-assembly and commissioning in the factory, and final approval at the customer’s premises.

SAUERESSIG’s large laminating unit coats both sides of the steel strip with a protective PET film

One such customized system, no less than six metres long and around four metres wide, coats a steel strip on both sides with a thin protective PET film. Harald Bartsch, Head of Design/Expert Advisor at SAUERESSIG Engineering, describes the machine’s design concept as follows “The complete laminating unit consists of two nearly identical, symmetrically arranged side frames, each with a rubberized laminating roller and a contact cooling roller. For laminating, the steel strip moves vertically between the two laminating rollers through the laminating unit at a conveying speed of up to 250 m/min. The laminating rollers press the film onto the hot steel strip from both sides.”

The steel strip’s high temperatures of up to 260 °C heat up the rubber coating on the laminating rollers. Water-cooled contact rollers dissipate this heat and limit the rubber coating’s temperature to a maximum of 90 °C. Despite the cooling, the rubber linings of the laminating rollers are subject to wear and must be replaced regularly. “As the laminating process should ideally be running continuously all year round and 24/7 without interruption,” explains Harald Bartsch, “the time required to replace the laminating rollers must be kept as short as possible. Therefore, the laminating unit is designed in such a way that the automated roller replacement only takes half an hour.”

The laminating unit consists of two symmetrically arranged side frames. Both side frames are mounted onto profiled rail guides and can be separated axially to replace the worn laminating rollers. While the coating process is in progress, profiled rail brake of the ROBA® guidestop® series by mayr® power transmission hold the two system parts in position backlash-free and with high rigidity. To replace the rollers, these safety brakes are released hydraulically, the two machine halves can be moved apart via rack and pinion gears and the laminating rollers can be replaced.

Profiled rail brake of the ROBA® guidestop® series by mayr® power transmission hold the two system parts of a large laminating unit in position backlash-free and with high rigidity.

The ROBA® guidestop® profiled rail brake serves as a reliable safety brake and backlash-free clamping unit. It can brake movements safely and quickly and clamps the axes rigidly and backlash-free.

Just like all safety brakes by mayr®power transmission, the profiled rail brakes also work according to the fail-safe principle. This means they are closed in de-energised condition. The ROBA® guidestop® brakes use pre-tensioned cup springs to press the brake shoes against the ‘waist’ of the profiled rail, thus clamping it in place.

The hydraulic brake design used in the SAUERESSIG laminating unit is released using a nominal pressure of 70 bar. This is comparatively low in relation to the very high holding forces. The brake mechanism is dimensioned for relatively large strokes. As a result, the brake can compensate for production tolerances on the profiled rails without losing braking force. The ROBA® guidestop® safety brakes are equipped with two independent brake circuits: This allows for either double holding forces or a redundant design.

The profiled rail brakes are therefore directly mounted onto the masses which are to be braked or held. This minimises the risk of hazards, particularly with gravity-loaded axles, as drive elements between the motor and the moving mass, such as spindles, spindle nuts, shaft couplings and gears, do not affect safety. This is different for concepts with motor brakes, as all drive elements must transmit the braking torque to the carriage. Furthermore, every element between the brake and the carriage has a negative effect on rigidity. ROBA® guidestop® safety brakes are therefore considerably more rigid than motor brakes, rod brakes or band brakes, which are often subject to backlash.

ROBA® guidestop® safety brakes by mayr® power transmission are available in pneumatic or electromagnetic versions in addition to the hydraulically opening design. The hydraulically releasing ROBA® guidestop® series covers nominal holding forces from 5000 to 34000 N with four sizes. The pneumatically releasing version offers the greatest variety of options: Six sizes with nominal holding forces from 700 to 15000 N are available in the standard product range. Both versions (i.e. pneumatically and hydraulically releasing) are available for all common linear guides. Electromagnetically opening rail brakes do not require any pneumatic or hydraulic equipment. mayr® power transmission developes this variant on request, customizing it for the respective application.

25, Feb 2026

Mr. Harsh Pawar wins Gold in 3D Digital Game Art at IndiaSkills Regional Competition; and Ms. Samruddhi Thombre secures full-time role with Galleri5

Mumbai, Feb 25: Arena Animation, a pioneer in animation, gaming, visual effects, and digital media education and a training brand of Aptech Limited, announced a dual milestone for its Nashik centre, a gold medal win at the regional round of the IndiaSkills Competition 2026 and a significant industry placement with Galleri5.

Mr. Harsh Pawar, student of Arena Animation, secured the Gold Medal in the 3D Digital Game Art category at the regional competition organised by the National Skill Development Corporation (NSDC). The competition was held in Gandhinagar, and it brought together top talent competing across advanced skill categories aligned to global standards. His victory underscores the strength of structured, industry-relevant training and reinforces Arena Animation’s growing presence on nationally validated competitive platforms.

Speaking on the occasion, Mr. Sandip Weling, Chief Business Officer, Global Retail, Aptech Limited, and Brand Custodian, Arena Animation said,

“The achievements of students are an outcome of the discipline, industry-aligned learning, and a mindset of excellence nurtured at Arena Animation. Our focus is to go beyond classroom training—building the competitive capability, creative confidence, and career resilience of all our students. As the Orange Economy continues to emerge and bloom as a powerful driver of growth, innovation, and employability in India, we are proud to play a catalytic role in equipping today’s young talent with skills that power the next phase of growth.”

Adding to the centre’s achievements, student Ms. Samruddhi Thombre has secured full-time employment with Galleri5 as an AI Cinematic Artist, marking a significant step in her professional journey. Her success reflects resilience and her laser-sharp focus. Determined to build a career in animation, she navigated challenges with clarity and conviction, often stating she “had no option but to succeed.”

Mr. Harsh Pawar, Gold Medalist (3D Digital Game Art) at IndiaSkills shared his reaction,

“Winning Gold at the IndiaSkills regional round is more than just a personal milestone; it’s a validation of the hours spent refining every polygon and texture under the guidance of my mentors at Arena. The competition in Gandhinagar was intense and truly mirrored global standards. This win has given me the confidence to know that my creative skills aren’t just a hobby-they are world-class. I’m now focused on carrying this momentum to the nationals.”

Ms. Samruddhi Thombre, who secured a placement at Galleri5, said

“I’ve always believed that in the creative industry, your portfolio is your passport, but your mindset is your engine. When I started my journey at Arena Nashik, I told myself I had no option but to succeed. Securing this placement at Galleri5 is the culmination of that ‘all-in’ approach. It feels incredible to transition from the classroom to a professional studio, and I’m eager to contribute to the industry I’ve spent so much time studying. For me, this is just the beginning of a lifelong career in animation.”

Together, these accomplishments highlight Arena Animation’s commitment to developing industry-ready professionals through skills-first training, hands-on exposure, and continuous mentorship. The institute remains focused on empowering students to transform creative passion into competitive excellence and sustainable career growth.

25, Feb 2026

EUR/USD Remains Under Pressure as the USD Maintains Its Advantage on Growth and Interest Rate Differentials

By Linh Tran, Market Analyst at XS.com

EUR/USD has continued its downward trend since peaking around 1.2080 at the end of January, as the divergence in economic prospects between the United States and the Eurozone has become increasingly evident. This movement reflects the current macroeconomic landscape, where the US dollar remains supported by relatively stable growth and inflation that is still above target, while the Eurozone faces slower expansion and lacks sufficient policy momentum to trigger a meaningful shift in expectations.

Recent US economic data suggest that growth has moderated but has not deteriorated significantly. GDP expanded by only 1.4% year-on-year in the fourth quarter, a notable slowdown from the 4.4% recorded in the third quarter, partly reflecting the impact of a prolonged government shutdown that disrupted public spending and investment. Nevertheless, for the full year 2025, the US economy still grew by 2.2%, its lowest pace since 2020 but sufficient to avoid a broad-based recession.

While growth has cooled, inflationary pressures have not fully subsided. Core PCE remained around 3.0% year-on-year, well above the Federal Reserve’s 2% target, forcing the central bank to maintain a cautious stance. At the same time, the US trade deficit in goods and services widened to approximately $901.5 billion in 2025, among the highest levels since records began in 1960, highlighting structural imbalances in external trade. However, with inflation still above target, the Fed’s primary policy focus remains price stability rather than growth stimulus.

The combination of slower but still positive growth and persistent inflation makes it difficult for the Fed to signal an early easing cycle. The “higher for longer” narrative continues to gain traction, keeping US Treasury yields relatively attractive compared to Europe. This yield differential remains a key factor supporting the US dollar and weighing on the euro.

On the other hand, the Eurozone has posted modest growth. The region’s GDP rose by 0.3% quarter-on-quarter in Q4 2025 and approximately 1.5% for the full year. Although the February Flash Composite PMI improved to 51.9 from 51.3 the previous month, indicating a mild expansion in overall activity, the pace of improvement remains insufficient to significantly alter expectations for ECB policy. In an environment of fragile growth, the ECB has less room to maintain a hawkish stance compared to the Fed.

In my view, the near-term outlook for EUR/USD will largely revolve around the policy divergence between the Fed and the ECB. With US policy rates still considerably higher than those in the Eurozone and core US inflation hovering around 3%, the Fed is unlikely to ease policy soon. Conversely, Eurozone inflation has eased to around 1.7% while growth remains modest, giving the ECB limited incentive to maintain a restrictive stance.

Under the base-case scenario, where US growth continues to slow but avoids a sharp downturn and inflation declines only gradually, the US dollar is likely to retain its relative advantage through yield differentials. The euro may only stage a sustained recovery if US economic data weaken sufficiently to push the Fed toward earlier-than-expected rate cuts. For now, the macro balance continues to tilt slightly in favor of the dollar, leaving EUR/USD more prone to sustained pressure than a decisive reversal.

25, Feb 2026

Dhoot Transmission Partners with FourFront to Scale Automotive Electronics Business

Bangalore, Feb 25: Dhoot Transmission Limited one of India’s leading electrical and electronic companies, today announced a partnership, pursuant to which FourFront Limited a Tier-1 supplier of customized electro-mechanical and electronic solutions to Original Equipment Manufacturers headquartered in Pune, will merge with one of the Company’s subsidiaries.

FourFront will become part of Dhoot Transmission’s automotive electronics and electrical platform, enabling the Company and its team to continue serving its existing customer base while moving towards the next phase of growth. The combined platform brings together complementary product capabilities, manufacturing depth, and long-standing OEM relationships to support the increasing electronics content and electrification requirements of the automotive industry.

FourFront is a trusted supplier to leading Passenger Vehicle (“PV”)and Commercial Vehicle (“CV”) OEMs in India, with a strong portfolio spanning electromechanical switches, power electronics products and electric vehicle (“EV”) products. With the rapid evolution of vehicle architectures and rising adoption of electric vehicles, FourFront is well poised to benefit from EV tailwinds, supported by its capabilities in power electronics, engineering depth, and focus on quality and reliability.

The merger represents an important step in the Company’s journey to build a scaled, integrated automotive electronics and electrical platform, offering end-to-end solutions to OEM customers across conventional and electric vehicle programs.

Bain Capital will continue to support Dhoot Transmissions and FourFront through its global automotive experience and value-creation capabilities, as it scales its automotive electronics and electrical platform and pursues its next phase of growth. This support is expected to further strengthen the combined platform’s ability to deepen OEM partnerships, expand product offerings, and drive operational excellence in line with evolving customer requirements.

Commenting on the transaction, Rahul Dhoot, Managing Director, Dhoot Transmission Group, said, “This partnership is closely aligned with our strategy of building a differentiated automotive platform with strong capabilities in electronics and electrical systems. FourFront has developed trusted relationships with OEM customers and built meaningful expertise in power electronics. As part of the Dhoot platform, FourFront and its team will be well positioned to continue delivering the same level of quality and service levels to customers while benefiting from our scale, manufacturing depth, and long-term investment approach.”

Saahil Bhatia, Partner at Bain Capital, said,

“India continues to be an economy with a strong long-term growth trajectory, supported by favourable demographics, rising domestic consumption, and sustained investment in manufacturing and infrastructure. Against this backdrop, we see a compelling opportunity to support platforms like Dhoot, and now FourFront, as they scale capabilities, deepen OEM partnerships, and build high-quality automotive solutions aligned with evolving technologies such as ADAS and increasing electronics content across vehicle segments.”

“Over the last 15+ years, FourFront has built very a strong foundation and is recognized for innovative solutions, superior design capabilities, and responsiveness towards customer demands,” said Shrikant Neurgaonkar, Chairperson and Managing Director at FourFront. “The partnership with Dhoot Transmission and Bain Capital will put us in a strong position to further enhance our product offerings and continue to invest in manufacturing facilities, R&D and people for the next phase of growth. We’re very excited to partner with Dhoot Transmission to create an electronics platform focused on technical and operational excellence.”

The partnership is expected to support growth by enabling broader product offerings, deeper customer engagement, and operational efficiencies through a shared manufacturing and supply-chain ecosystem. It also strengthens the Company’s presence across PV and CV segments, aligned with long-term industry trends, including electrification and increasing electronics penetration.

KPMG and PwC served as financial advisors, and Trilegal served as legal advisors to Dhoot Transmission. KPMG Corporate Finance and Desai & Diwanji served as advisors to FourFront

25, Feb 2026

Caspia Launches New RTL Security Analyzer Enabling Agentic Silicon Security Verification

GAINESVILLE, Fla., Feb. 25: Caspia Technologies announced broad availability of its flagship security verification product CODAx. New and unique capabilities delivered by the product were described, along with its impact on the customer base. The company also provided a preview of its plans to build agentic security verification workflows.

CODAx is Caspia’s security-aware auditing solution that analyzes early (RTL) code of IP/SoC designs to detect coding styles that can introduce security vulnerabilities. Over 150 insecure coding practices are recognized and suggested corrections are also provided.

CODAx security checks are informed by public vulnerability databases including CWE, CVE, and Trust-Hub, which catalog over 1,000 known hardware security weaknesses. Caspia applies GenAI techniques to systematically map these weaknesses to detectable RTL coding patterns.

The latest release of CODAx, V2026.1 provides deeper security checks that span across the design hierarchy, enabling identification of weaknesses that travel up and across design modules. The company reported that comprehensive stress testing was performed on this release with 10,000+ intentionally vulnerable designs.

Caspia also reported that a popular open-source root-of-trust design containing 400+ design files, approximately 3 million gates, and 500,000 lines of RTL code was analyzed by CODAx in about 45 minutes. Multiple security weaknesses were found during this analysis.

Caspia has been working with all the major EDA suppliers to ensure a smooth integration of its tools with existing design flows. The company also reported that major chip and system companies from around the world are successfully deploying CODAx for designs that support applications such as automotive, data center, communication, storage, multimedia, precision analog and embedded computing.

Caspia announced that Stuart Audley has joined the company as VP/GM of product management, with a focus on agentic security workflows. Audley brings decades of experience designing and deploying cryptographic hardware and security IP for top defense primes and leading semiconductor companies. He previously led advanced security platform development for FPGAs and ASICs at The Athena Group, Inc. and Mercury Systems.

“We are expanding our security verification footprint to include both advanced tools and enablement of agentic workflows,” said Rick Hegberg, CEO of Caspia. “I am delighted to add someone with Stuart’s experience and background to the team. This will ensure we can focus on delivering cutting-edge capabilities and AI-driven security automation.”

“Caspia is evolving from a provider of point security verification tools to an agentic platform supplier where AI orchestrates comprehensive hardware security workflows,” said Audley.

He went on to say, “the elements of our plan include unifying all our tools with AI-assisted workflows that span the entire hardware security lifecycle: analyzing RTL, identifying vulnerabilities, and verifying the results.

Traditional design flows remain fully supported, but we are creating a new category for agentic-enabled hardware security verification.”

Caspia will present its latest technology in booth 702 at DVCon on March 2-5, 2026, to be held at the Santa Clara Hyatt Regency in Santa Clara, CA.

25, Feb 2026

India’s Luxury Destination for Grand Weddings – Where Scale, Spectacle, and Sophistication Converge at Fairmont Mumbai

Mumbai, Feb 25: Designed to host the most extraordinary moments of a lifetime, Fairmont Mumbai emerges as one of India’s most definitive destinations for luxury weddings and milestone celebrations. Home to one of the country’s largest and most technologically advanced banqueting portfolios, the hotel brings together monumental scale, architectural drama, and deeply personalised service—setting a new benchmark for grand Indian weddings, receptions, and multi-day celebrations.

From opulent wedding galas hosting over 2,000 guests to intimate mehendi lunches, cocktail soirées, and elegant receptions, Fairmont Mumbai seamlessly blends grandeur with warmth—creating celebrations that feel expansive yet exquisitely personal.

Where Wedding Grandeur Meets Thoughtful Craft

Every celebration space at Fairmont Mumbai has been envisioned as an immersive canvas—architecturally bold, technologically seamless, and intuitively designed to translate a couple’s vision into unforgettable reality. State-of-the-art, plug-and-play infrastructure allows for effortless customisation, while layered design details lend each venue a sense of timeless elegance.

Golden accents add understated opulence, while bespoke carpets inspired by Paithani sarees—crafted by artisans from Maharashtra—root the spaces in regional heritage. Even at a monumental scale, the experience remains bespoke, with dedicated wedding specialists ensuring every detail—from décor and culinary journeys to guest flow and ceremonies—is thoughtfully curated.

Innovative ceiling structures with a 100-tonne hanging capacity allow for dramatic floral installations, chandeliers, and aerial performances, while a dedicated car lift enables luxury vehicle entries—transforming bridal arrivals and baraats into unforgettable moments of theatre.

A Versatile Canvas for Every Wedding Moment

Fairmont Mumbai’s expansive celebration venues offer unparalleled flexibility for multi-event weddings and large-scale festivities:

-

Infinity Ballroom: A breathtaking 21,000 sq. ft. pillarless ballroom complemented by an equally expansive 21,000 sq. ft. pre-function area with two live theatre kitchens—ideal for grand wedding ceremonies and receptions hosting up to 2,000 guests.

-

Eon Ballroom: A chic, high-energy venue with a built-in bar, perfect for sangeet nights, cocktail celebrations, and stylish after-parties.

-

The Vantage: A 12,000 sq. ft. rooftop venue with sweeping views of the city and airport, designed for elegant open-air celebrations, sunset pheras, and evening receptions under the stars.

-

Samaa: A refined rooftop setting offering an intimate yet atmospheric backdrop for pre-wedding soirées, haldi and mehendi celebrations, curated cocktail evenings, and close-knit wedding festivities—where elevated cuisine, ambient lighting, and open skies come together to create unforgettable moments.

-

Grand Terminus: A sophisticated space for intimate gatherings, family meetings, and private wedding functions.

A Destination Designed for Once-in-a-Lifetime Celebrations

“Fairmont Mumbai’s wedding and celebration offering has been thoughtfully conceived as a destination in itself—where scale is matched by sensitivity, and grandeur is delivered with intent. Every wedding hosted here is a deeply personal journey, elevated through design, technology, and the signature Fairmont approach to service. Our vision is to create a setting where India’s most meaningful celebrations unfold with effortless elegance.” — Rajiv Kapoor, General Manager, Fairmont Mumbai

“Fairmont Mumbai represents a defining chapter in our vision to build enduring destinations that host the most important moments in people’s lives. The scale and ambition of its celebration spaces reflect our commitment to creating landmarks designed for generations of weddings and milestones. Together with Fairmont, we have created an address where heritage, architecture, and contemporary luxury come together to celebrate love and legacy.” — Nitan Chhatwal, Chairman & Managing Director, Shrem Group

The New Address for Iconic Weddings in India

In a city where celebrations are woven into everyday life, Fairmont Mumbai stands apart as a destination designed for weddings that demand scale, sophistication, and soul—redefining how landmark celebrations are imagined and experienced.