3, Mar 2026

New Research Offers Businesses a Playbook for Surviving Social Media Firestorms

By Anthony Borrelli

This was how critics labeled a 30-second Peloton holiday ad in 2019 that featured a man giving a woman an exercise bike as a gift. Backlash was so severe that Peloton’s stock fell by about 9%, after social media erupted over perceived outdated gender roles and body image standards.

Researchers describe this kind of reaction as online social disapproval (OSD) — the public expression of criticism against businesses on digital platforms — which can rapidly escalate into bursts of public responses with significant reputational and financial consequences. For instance, in 2023, Bud Light faced boycotts and sales declines following backlash over its partnership with a transgender influencer.

In response, new research co-authored by Associate Professor Jinglu Jiang from the Binghamton University School of Management introduces a digital toolkit designed to help organizations anticipate, interpret, and respond to social media backlash more effectively. The conceptual paper, “Bursts of online social disapproval: leveraging analytics for comprehension and detection,”(opens in a new window) was published in the Journal of Business Strategy.

The toolkit, developed by combining a review of existing research with real-world cases, identified four phases of OSD — preburst, initial burst, spreading and contagion, and recalibration — that explain how backlash emerges and evolves over time.

“The whole point is that online social disapproval is different from traditional crisis management. It’s not linear; it’s more like a cycle, because of how the internet and social media algorithms create different bursting patterns affecting how these kinds of responses can spread,” Jiang said. “Negative opinions become a battlefield in the spreading phase, and sometimes one perspective emerges as more dominant. When things settle down and get back to normal, that’s when management should revert to prebursting monitoring practices, rather than just waiting for it to happen again.”

Jinglu Jiang, associate professor in the Binghamton University School of Management. Image Credit: Jonathan Cohen.

Using the four phases, the study offers guiding questions and analytical indicators to give managers more robust capabilities for early detection, response, and recovery:

- Preburst: Is there a process to monitor emerging trends within your firm?

- Initial burst: Have you identified indicators for OSD popularity?

- Spread and contagion: Is a company-specific burstiness threshold defined? Is a structured procedure in place to monitor OSD burst trajectories?

- Recalibration: Have situational and long-term impact measures been defined?

For the final phase, researchers said the critical question is not simply whether online activity has subsided, but what lasting imprint the OSD burst has left on the organization.

“In the short term, firms can track immediate market and financial responses, such as sales fluctuations, stock price volatility, or shifts in customer traffic. These indicators provide situational feedback on the material consequences of the burst,” the study stated. “However, analytics also structure longer-term interpretations by highlighting enduring reputational shifts. Measures such as customer satisfaction, online review trends, survey-based reputation indices, and social media engagement reveal whether stakeholder trust is recovering or whether skepticism persists.”

Each business needs to define its own baseline “normality” for how the public responds on social media to different events or situations for this type of toolkit to be effective, Jiang said. The study also cautions that older events can resurface unexpectedly, triggering renewed backlash as past news and content are rediscovered online.

“The moment you observe that initial burst online, you need to be cautious and strategic about how you respond,” Jiang said, “because once it enters the spreading and contentious phase, it can become a social media battlefield that’s more difficult to contain. That’s something any business would want to avoid.”

Photo: This was how critics labeled a 30-second Peloton holiday ad in 2019 that featured a man giving a woman an exercise bike as a gift. Backlash was so severe that Peloton’s stock fell by about 9%, after social media erupted over perceived outdated gender roles and body image standards.

Researchers describe this kind of reaction as online social disapproval (OSD) — the public expression of criticism against businesses on digital platforms — which can rapidly escalate into bursts of public responses with significant reputational and financial consequences. For instance, in 2023, Bud Light faced boycotts and sales declines following backlash over its partnership with a transgender influencer.

In response, new research co-authored by Associate Professor Jinglu Jiang from the Binghamton University School of Management introduces a digital toolkit designed to help organizations anticipate, interpret, and respond to social media backlash more effectively. The conceptual paper, “Bursts of online social disapproval: leveraging analytics for comprehension and detection,”(opens in a new window) was published in the Journal of Business Strategy.

The toolkit, developed by combining a review of existing research with real-world cases, identified four phases of OSD — preburst, initial burst, spreading and contagion, and recalibration — that explain how backlash emerges and evolves over time.

“The whole point is that online social disapproval is different from traditional crisis management. It’s not linear; it’s more like a cycle, because of how the internet and social media algorithms create different bursting patterns affecting how these kinds of responses can spread,” Jiang said. “Negative opinions become a battlefield in the spreading phase, and sometimes one perspective emerges as more dominant. When things settle down and get back to normal, that’s when management should revert to prebursting monitoring practices, rather than just waiting for it to happen again.”

Using the four phases, the study offers guiding questions and analytical indicators to give managers more robust capabilities for early detection, response, and recovery:

- Preburst: Is there a process to monitor emerging trends within your firm?

- Initial burst: Have you identified indicators for OSD popularity?

- Spread and contagion: Is a company-specific burstiness threshold defined? Is a structured procedure in place to monitor OSD burst trajectories?

- Recalibration: Have situational and long-term impact measures been defined?

For the final phase, researchers said the critical question is not simply whether online activity has subsided, but what lasting imprint the OSD burst has left on the organization.

“In the short term, firms can track immediate market and financial responses, such as sales fluctuations, stock price volatility, or shifts in customer traffic. These indicators provide situational feedback on the material consequences of the burst,” the study stated. “However, analytics also structure longer-term interpretations by highlighting enduring reputational shifts. Measures such as customer satisfaction, online review trends, survey-based reputation indices, and social media engagement reveal whether stakeholder trust is recovering or whether skepticism persists.”

Each business needs to define its own baseline “normality” for how the public responds on social media to different events or situations for this type of toolkit to be effective, Jiang said. The study also cautions that older events can resurface unexpectedly, triggering renewed backlash as past news and content are rediscovered online.

“The moment you observe that initial burst online, you need to be cautious and strategic about how you respond,” Jiang said, “because once it enters the spreading and contentious phase, it can become a social media battlefield that’s more difficult to contain. That’s something any business would want to avoid.”

- 0

- By Neel Achary

3, Mar 2026

Hasiru Habba 2.0 Unites Residents at Gopalan Olympia to Champion Sustainable Living

Bengaluru, Mar 03: What happens when residents take ownership of their neighbourhood’s environmental footprint? At Gopalan Olympia, that intention became action through Hasiru Habba 2.0, a resident-led initiative focused on promoting sustainable living practices among residents and local vendors.

Hosted at Yuva Tarabeti Kendra, the event was organised by the Hasiru Hejje Swaccha Usiru Citizen Collective, a community of residents from the surrounding neighbourhood, in partnership with Kumbalgodu Gram Panchayat. Designed as a platform for community engagement, Hasiru Habba 2.0 encouraged practical, on-ground conversations around responsible waste management, mindful consumption, and eco-friendly lifestyle choices at the neighbourhood level.

“We believe sustainable communities are built when residents take the lead, and we are proud to support initiatives like Hasiru Habba 2.0 at Gopalan Olympia. By enabling such platforms, we hope to inspire meaningful change and foster a culture of responsibility and conscious living within our neighbourhoods,” said Dr. C. Prabhakar, Director, Gopalan Enterprises.

The event turned sustainability into action. Residents, volunteers, and local vendors participated in interactive sessions demonstrating how small, consistent efforts—such as waste segregation at the source and reducing single-use plastics—can collectively make a significant environmental impact.

At its core, Hasiru Habba 2.0 showcased the power of citizen-driven movements, where solutions emerge organically from within the community. Gopalan Olympia, as the host community, played a pivotal role in fostering a residential ecosystem that supports community-led sustainability initiatives and encourages civic participation at the grassroots level.

Supporting the initiative, Gopalan Enterprises distributed approximately 1,500 reusable jute bags to local vegetable vendors, retail shops, pushcart sellers, and cloth merchants to actively reduce single-use plastic usage. Additionally, seed-paper tags were provided to promote tree planting and encourage long-term behavioral change. The Group also assisted with on-ground efforts for area clean-up and waste management during the event.

Beyond Hasiru Habba 2.0, Gopalan Enterprises has undertaken regular maintenance and upkeep of the Olympia vicinity, including road cleaning, debris removal, and monitoring to ensure the area remains orderly, safe, and environmentally friendly for residents and commuters.

The event reflected strong collective engagement, marking a positive step toward building a cleaner, greener, and more environmentally conscious community. Through initiatives like Hasiru Habba 2.0, Gopalan Enterprises continues to demonstrate its belief that responsibility extends beyond property boundaries and into the shared urban environment.

3, Mar 2026

Lakshmipriya Devi Shines in 11 Tareng at the 79th BAFTA Awards

Lakshmipriya Devi, best known for directing the Manipuri-language film Boong, was spotted wearing 11 Tareng at the 79th BAFTA Awards, where her film won the Best Children’s and Family Film award. Inspired by the traditional Phanek and Phee, the brand designed a minimal yet striking ensemble in Lavender Grey from its ‘Phiruk’ collection.

3, Mar 2026

The Central African Republic has launched a high-quality digitization project

| The platform is built on an open-source microservices architecture with high resiliency (99.8% availability), encrypted data structure, and API interoperability |

| BANGUI, Central African Republic, Mar 3: A historic step in the modernization of the Central African Republic’s public administration. With the official launch of the Dûnîa digital platform, an entire ministry was fully digitized for the first time – both in terms of internal processes and cooperation with external partners.

The platform was developed on behalf of the Ministry of Economy, Planning and International Cooperation (MEPCI) and marks a unique structural shift in the governance of economic policy, development planning and international partnerships. The official launch of this Platform took place on February 23, 2026 under the patronage of the President of the Republic, Head of State, Professor Faustin Archange Touadera, and is under the banner of the National Development Plan (NDP-2024-2028). “Dûnîa is much more than just an e-government project. It is an integrated, modular and scalable digital platform that maps all of the ministry’s administrative, operational and strategic processes. A strategic lever for development and digitalisation – and an important element of our Ambition28 programme,” says Professor Richard Filakota, Minister of Economy, Planning and International Cooperation. On the platform, all HR and budget management processes of the Ministry of the Economy are automated: document management is managed entirely electronically, project management is digitally centralized, macroeconomic analyses are modeled based on data and international funding is tracked transparently. The platform is built on an open-source microservices architecture with high resiliency (99.8% availability), encrypted data structure, and API interoperability. Concrete gains in efficiency and transparency Digitalization brings measurable improvements. Administrative processing times are reduced by up to 70%. Around 40% of human resources can be used for value-added tasks in the future. In the case of recurring administrative costs, a potential savings of up to 30% is expected. In addition, all processes will be fully digitally traceable in the future to minimize the risk of corruption. After all, reporting is carried out in accordance with international standards – and in an automated way. Of particular importance is the new central project register, which for the first time brings together all governmental, international and humanitarian projects in a common database. This reduces information gaps and avoids duplication of structures – an important step towards making more effective use of international development funds. Digital governance of more than $9 billion in development finance The platform directly supports the implementation of the National Development Plan 2024–2028, for which more than USD 9 billion has been mobilized as part of the International Investors Roundtable held in Casablanca in September 2025. By grouping and digitally coordinating all projects, overlaps can be reduced and a potential savings of 15 to 20 percent can be realized. In addition, outflows of funds are accelerated, impact assessments are improved and territorial imbalances are compensated. This makes digitalization the central instrument for effective development management. The development and implementation of Dûnîa is carried out in partnership with the Central African technology company EDEN TiiiT, led by Cédric PIDJOU who pre-financed the previous phases of the project from his own funds. “This model underlines the growing role of the local private sector in the country’s digital transformation and sends a strong signal to international partners and investors,” says Professor Richard Filakota. “With Dûnîa, the Central African Republic is positioning itself as a pioneer in digital administrative modernization. A model of digital sovereignty for a country! » This platform strengthens the state’s capacity for action, increases transparency and accountability, and creates the basis for evidence-based policymaking. The digitalization of the Ministry is therefore not only a technological step, but also a strategic cornerstone for sustainable growth, institutional stability and international partnership. The name Dûnîa means “the world, the universe, a place with an infinite number of solutions” in Sango, the local language. It was chosen to symbolize the opening of the CAR to the world, its repositioning among the countries with high digital potential, and the acceleration of its economic growth thanks to an infinite number of innovative solutions. |

3, Mar 2026

MDI Regenerative Business Research Discussed at International Doctoral Consortium and ICCMRO 2026 at MDI Gurgaon

Gurgaon, Mar 03: Management Development Institute Gurgaon hosted a two-day academic programme from February 20 to 24, 2026, centred on the theme “Beyond Sustainability: Creating and Sustaining Regenerative Businesses.” The programme brought together the International Doctoral & Early-Career Academics Consortium and the 2nd ICCMRO International Conference 2026, convening scholars, journal editors, and industry practitioners from India and overseas, including representation from partner institutions such as BFH Switzerland, led by Prof. Ingrid Kissling, Director, Business School, BFH Switzerland.

Against the backdrop of evolving sustainability conversations—where the focus is shifting from policy commitments and disclosures to measurable outcomes and system-level impact—the discussions examined how businesses can move beyond incremental ESG compliance towards regenerative models that restore social, environmental, and institutional value.

The initiative brought together doctoral scholars, early-career academics, senior researchers, journal editors, and industry representatives to deliberate on regenerative business practices, ESG-linked governance, ethical decision-making, and responsible management education, with an emphasis on analytical rigour and empirical grounding.

The programme opened with the International Doctoral & Early-Career Academics Consortium on February 20. The inaugural session featured remarks by Prof. Tanuja Sharma and Prof. Ritu Srivastava. Keynote sessions explored the evolving relationship between enterprise, accountability, and long-term value creation.

Anil Gupta, Founder of the Honey Bee Network, highlighted the importance of grassroots innovation and community-embedded knowledge systems in building inclusive and resilient enterprises. Karen Maas of the Open University and Erasmus University addressed impact measurement, sustainability reporting, and the growing demand for evidence-based evaluation of ESG outcomes, noting that credibility increasingly depends on methodological robustness rather than narrative intent.

A panel discussion on “Ethics and Principles for Sustainability in Business” featured perspectives from academia and industry, including Abhishek Chandra and Harry Van Buren from the University of Tennessee, Chattanooga. Panellists discussed ethical governance, accountability mechanisms, and the role of academic research in shaping responsible corporate conduct, emphasising that sustainability must be embedded in decision-making structures rather than treated as an adjunct function.

Emphasising the importance of international academic collaboration, Maya Tissafi, Swiss Ambassador, underscored the growing relevance of partnerships between Indian and Swiss business schools in shaping the future of responsible enterprise. She called upon academia to take its rightful place in the global sustainability movement, noting that universities must move beyond observation to leadership. Highlighting the long-term consequences of present-day decisions, she remarked that the choices we make today are the seeds of tomorrow’s growth, and stressed that cross-border collaboration in research, teaching, and leadership development would be critical to advancing regenerative and inclusive economic models.

Subsequent consortium sessions focused on research methodology, community-engaged scholarship, and publication processes, reflecting the growing expectation that sustainability research demonstrate both theoretical depth and practical relevance. Doctoral participants engaged in master classes and feedback clinics aimed at strengthening research design, causal reasoning, and contribution to international scholarship.

The concluding phase comprised the 2nd ICCMRO International Conference 2026, featuring paper presentations and plenary sessions on stakeholder accountability, climate-related disclosures, governance frameworks, and cross-sectoral sustainability challenges. Researchers and practitioners examined how governance systems can support long-term resilience in the face of environmental and social disruption.

Professor Tanuja Sharma, Chairperson, CERO, MDI Gurgaon, added: “Sustainability research today is increasingly concerned with systems, governance, and long-term value creation rather than checklist-based compliance. Academic platforms such as doctoral consortia enable researchers to test ideas rigorously, sharpen methodologies, and situate their work within broader societal and organisational contexts”

The programme concluded with a vote of thanks by Prof. Vanita Singh, who acknowledged the contributions of keynote speakers, panellists, doctoral scholars, research presenters, institutional partners, and organising teams. She highlighted the collective effort that enabled rigorous academic exchange and international collaboration, noting that such platforms play a vital role in advancing thoughtful, evidence-led discourse on sustainability, ethics, and regenerative business practice.

2, Mar 2026

TEDxHRCollege 2026 Explores “Beyond the Horizon” at Its 11th Edition

Mar 2:TEDxHRCollege is the official TEDx platform of HR College of Commerce and Economics, created to bring the global spirit of TED to a student-led stage in Mumbai. Marking its 11th edition, TEDxHRCollege was held at the C.K. Nayudu Banquet Hall, Cricket Club of India, under the theme “Beyond the Horizon.” Independently organized by students and licensed by TED, the event embodied the mission of “Ideas Worth Spreading,” encouraging audiences to challenge boundaries and envision possibilities beyond the visible.

The event commenced with a classical performance followed by welcome addresses by Principal Dr. Pooja Ramchandani and Head Organizer Ms. Palak Gala.

The speaker lineup featured diverse voices across leadership, literature, and corporate foresight:

Mr. Bharat Dash, management professional, reflected on the enduring relevance of the Panchatantra, contrasting its emotional intelligence and storytelling depth with conventional presentation formats.

Mr. Yusuf Poonawala, entrepreneur and author of The Balanced Leader, delivered “When Everything Burns Down, What Remains?”, urging audiences to build character, values, and resilience beyond titles and applause.

Ms. Alpa Vora, Child Protection Specialist at UNICEF India, spotlighted youth-led initiatives in Maharashtra that safeguard children’s rights and strengthen communities.

Ms. Kaveri Ingale explored leadership through cinematic narratives, emphasizing courage, accountability, and authenticity as everyday practices.

Mr. Vesmir, poet and author, examined the cognitive and emotional implications of over-reliance on AI, advocating literature as essential for human resilience.

Ms. Kamayani Nagar, Head of Retail at Aditya Birla Sun Life, spoke on preparing for corporate life in 2036, highlighting adaptability, AI literacy, ethical judgment, and continuous learning as future essentials.

Ms. Priyadarshini Indalkar, acclaimed Marathi actress, addressed the “Fear of Failure,” encouraging resilience, empathy, and authenticity in navigating personal and professional challenges.

The event would not have been possible without the unwavering support and guidance of our Principal, Dr. Pooja Ramchandani, and our Faculty In-Charge, Prof. Chandani Bhattacharjee. Their constant encouragement, trust and thoughtful mentorship laid the foundation for its success. Their belief in our vision empowered us to execute the event with confidence, responsibility, and excellence.

Beyond being a platform for ideas, TEDxHRCollege is a transformative learning experience. It enables students to build strong communities while developing leadership, communication, hospitality, and problem-solving skills. By taking ownership of real responsibilities, students grow not only as organizers but as capable, confident individuals ready to lead beyond the horizon.

2, Mar 2026

VST Tillers Tractors Wins Best Farm Machinery Display & State Excellence Award at Global Agro Tech 2026

Uttar Pradesh, India | Mar 2: VST Tillers Tractors Ltd, a pioneer in farm mechanization and an undisputed leader in the power tiller segment, has been conferred with the prestigious State Excellence Award at Global Agro Tech 2026, held in Uttar Pradesh. The award was presented by H.E. Anandiben Patel, Hon’ble Governor of Uttar Pradesh, to senior officials of the company in recognition of its pioneering contribution to advancing small and compact farm mechanization in India. In addition to this recognition, VST also received the Best Stall Display Award for showcasing a comprehensive portfolio of innovative farm mechanization solutions tailored to diverse agricultural needs.

At the exhibition, VST displayed its complete range of products spanning from 5 HP to 50 HP, offering integrated solutions for key segments including sugarcane cultivation, orchard farming, and inter-cultivation operations. The display highlighted VST’s commitment to enabling small and marginal farmers with efficient, cost-effective, and technology-driven farm equipment.

The VST stall at the event attracted significant interest from farmers, agri-entrepreneurs, dealers, and policymakers, demonstrating VST’s leadership in compact tractors, power tillers, and specialized farm machinery designed for Indian farming conditions. The recognition at Global Agro Tech 2026 further reinforces VST Tillers Tractors’ position as a frontrunner in sustainable and scalable farm mechanization, supporting enhanced productivity and rural prosperity across the country.

2, Mar 2026

United Way Bengaluru Announced as Philanthropy Partner for TCS World 10K Marathon 2026

Bengaluru, Mar 2: United Way Bengaluru (UWBe) proudly steps up as the official Philanthropy Partner for the TCS World 10K Marathon, scheduled to be held on April 26, 2026, in Bengaluru.

This year, UWBe provides a structured fundraising platform that empowers participants to support credible grassroots initiatives in education, environment, women empowerment, sports, healthcare, and community development.

As a trusted partner, UWBe ensures every contribution undergoes rigorous due diligence and monitoring, directing funds precisely to the communities that need them most.

For United Way Bengaluru, this is more than just a run; it’s a powerful opportunity for corporates, communities, and individuals to unite and drive meaningful change. Through transparent processes, UWBe connects supporters with NGOs creating real impact on the ground. United Way Bengaluru requests corporates, CSR leaders, NGOs, institutions, and passionate individuals to join hands as changemakers. Participate in the run, fundraise, and turn steps into lasting progress.

2, Mar 2026

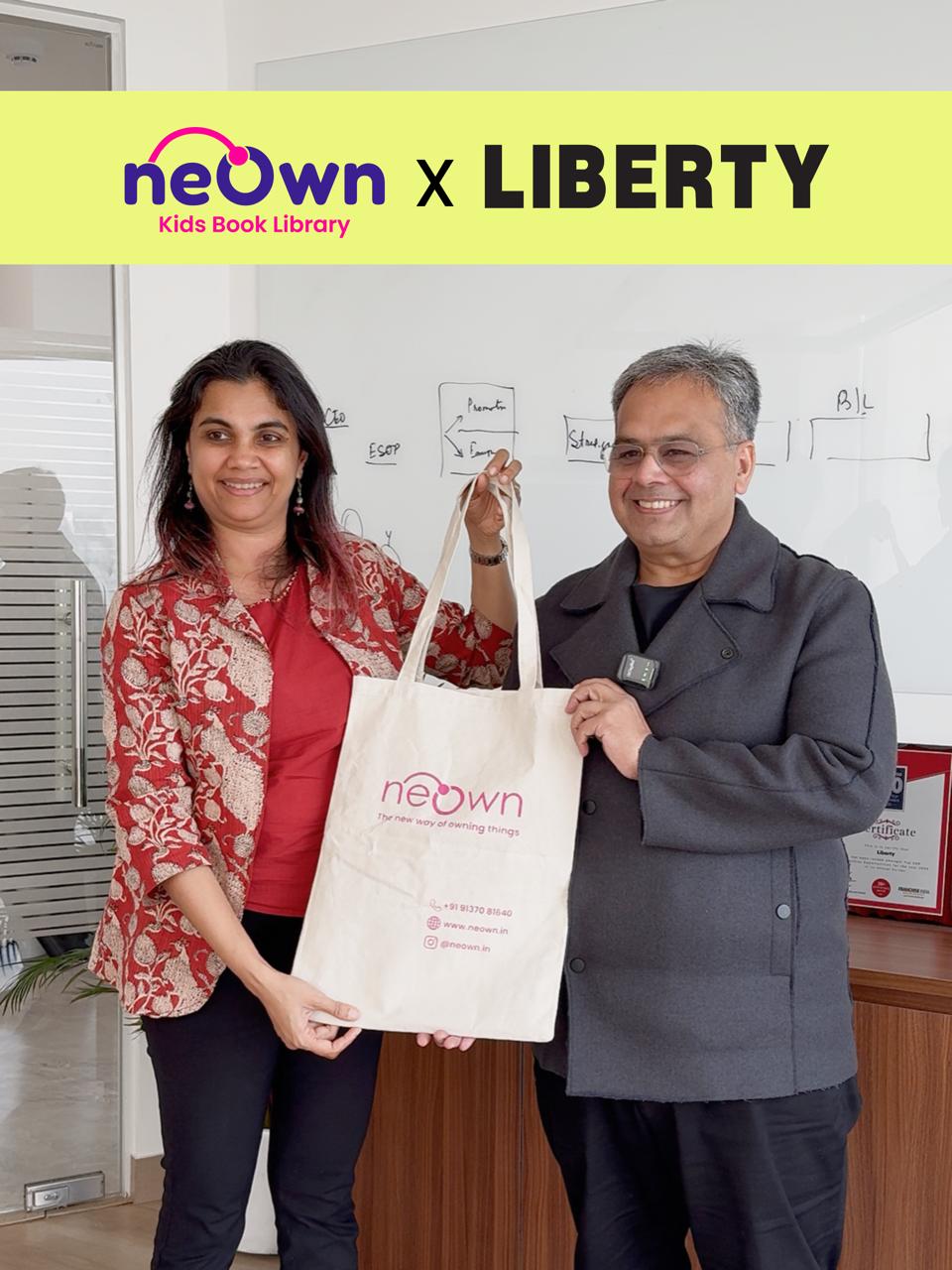

Liberty Shoes Partners with neOwn to Bring India’s Reading Revolution to Bangalore

March 02: Liberty Shoes Limited, one of India’s leading footwear brands, has announced a partnership with neOwn, India’s first app-based book rental service for children. For a month, all 25 Liberty stores across Bangalore will provide customers with an exclusive ₹500 discount voucher, with every liberty purchase, redeemable on any neOwn subscription. Liberty‘s approach positions this offer as added value for customers.

neOwn, founded by Kranti Gada (former COO of Shemaroo Entertainment Ltd.), appeared on IdeaBaaz and earned the attention and support of retail industry leader Anupam Bansal, Executive Director of Liberty Shoes, who was one of the Titans on the show.

Discussions between the two companies led to this collaboration, positioning Liberty as a brand that invests not just in children’s footwear, but in their holistic development.

The collaboration represents a shift in how physical retail can add value beyond transactions. Rather than simply completing a sale, Liberty stores now offer parents an opportunity to invest in their children’s cognitive development alongside their physical growth.

“I am deeply grateful to Mr. Bansal for seeing the potential in what we are building,” said Kranti Gada, Founder of neOwn. “Mr. Bansal offered valuable insights from being in the retail business for decades, along with access to Liberty‘s retail infrastructure. This partnership validates our mission in a way that goes beyond capital. It is a testament to the power of believing in a shared vision: that every child deserves to be introduced to books early to grow confident, both physically and mentally.”

“Business today has evolved beyond commercial transactions. Today’s customers are looking for brands that add real value to their lives.” says Mr. Anupam Bansal, Executive Director, Liberty Shoes, “When I met Kranti on IdeaBaaz, I saw a founder who is building something that genuinely helps parents raise confident children. Liberty has the retail infrastructure to help scale that impact. Sometimes the best partnerships aren’t about funding, they are about finding aligned missions and acting on it together. Good shoes give children the physical confidence to explore the world. Good books give them the mental tools to understand it. This partnership makes both accessible to the families who trust Liberty. It’s a natural fit.”

The partnership is supported by a co-branded social media campaign highlighting the connection between physical and mental development in children. Both brands are creating educational content for parents around building confidence through holistic growth.

The Bangalore pilot represents the first phase of what could become a model for similar partnerships nationwide, demonstrating how established brands can support emerging startups while adding meaningful value for customers.

2, Mar 2026

Veeam Introduces Agent Commander to Confront Agentic AI Risk at Enterprise Scale

India March 02: Veeam® Software, , the Data and AI Trust Company, today announced Agent Commander, the first unified solution to help organizations safely detect AI risk, protect AI systems, and undo AI mistakes, empowering them to proactively address AI-driven risks and securely scale AI agents everywhere. The first integration from Veeam’s successful acquisition of Securiti AI, Agent Commander combines the market-leading capabilities of both to give organizations visibility, control, and protection over their entire data and AI estate, with the ability to undo AI mistakes with precision and ease. Agent Commander will be available in a future release of the Securiti Data Command Center, bringing together the industry’s leading Data Resilience and Data Security capabilities.

“AI happens at machine speed, which means organizations must understand what data is being used, by what agent, and how in real-time. If an error occurs, organizations not only need to understand what data was impacted, but they also need the ability to undo any damage rapidly,” said Anand Eswaran, CEO of Veeam. “With Agent Commander, organizations know what data is powering AI, and it gives them the power to detect, protect, and, when necessary, undo AI actions with speed and precision. It represents the future of what’s expected from data security and data resilience, and it’s only possible with Veeam’s unified platform.”

The most critical gap in AI infrastructure today is trust. As AI agents scale, data risk and AI risk have become the same problem. An agent is only as trustworthy as the data it can see, access, and act on. Yet enterprise controls remain fragmented with separate systems for protection, security, governance, and recovery, and none built to provide unified visibility, granular control, or precision response at the speed and scale AI now demands. Sensitive data is being fed into models and acted upon in ways no one approved nor is tracking. As AI moves at machine speed an AI agent can access and act on sensitive data in seconds. Traditional workflows that take hours to detect and days to remediate leave too much exposure at that velocity.

Closing this gap requires a new layer of AI infrastructure: a unified control plane that delivers contextual visibility, policy-level enforcement, and surgical recovery, converging data resilience, data security, and AI risk management into one operational system.

Agent Commander brings Veeam’s trusted data resilience together with Securiti AI’s Data Command Center. This unified platform gives organizations total visibility into their AI environment, detects hidden risks and Shadow AI, and provides comprehensive controls to protect data as it moves through AI systems. Uniquely, Agent Commander can instantly undo AI agent mistakes with precise rollbacks. With Agent Commander, teams can detect and fix threats faster and with less effort, enabling safe and rapid AI adoption. It provides the visibility and control needed to confidently scale AI, turning security into a true business accelerator.

What Makes Agent Commander Unique?

At the core of Agent Commander is Veeam’s Data Command Graph™ — a real-time relational intelligence engine that maps live connections between data, identities, AI models, and autonomous agents across production and backup environments.

Veeam sees what others can’t. The toxic combinations where compromised identities, exposed data, and autonomous agents intersect — and how those risks compound, cascade, and evolve in real time across the entire data and AI estate.

That’s why no standalone AI security or backup solution can do what Agent Commander does. Combined with Veeam’s enterprise-grade data resilience platform, it delivers three capabilities the industry has never seen together.

- Detect AI Risk with Context

Identify shadow AI, sensitive data exposure, and risky agent behavior, with full visibility into downstream impact across systems and environments.

- Protect AI Pipelines Autonomously

Enforce granular, real-time controls across data, identities, and AI agents, independent of model providers, cloud platforms, and hybrid needs.

- Undo AI Mistakes with Precision

Surgically reverse unwanted AI actions using precise, context-aware recovery, restoring trusted data without reverting entire systems.

By converging relational AI intelligence with proven resilience infrastructure, Agent Commander establishes a new standard for trusted, recoverable AI at scale.

“As AI becomes operational infrastructure, enterprises can no longer treat data protection, data and AI security, privacy, and governance as separate disciplines,” said Rehan Jalil, President of Products & Technology at Veeam. “Controlling AI risk is effectively impossible in siloed environments or without deep contextual intelligence across data, permissions, and autonomous agents. Agent Commander unifies control across production and backup to detect toxic combinations, enforce granular policy, and precisely reverse AI-driven actions. This is the foundation required to operate AI safely at enterprise scale.”

“Acquisitions often raise the question of how combined strengths can create new customer value,” said Todd Thiemann, Principal Analyst, AIM & Data Security at Omdia. “Veeam’s announcement provides a clear roadmap for integrating capabilities and delivering enhanced solutions to organizations securing their data and AI estates. The focus on Agent Commander demonstrates Veeam’s commitment to provide both operational efficiency and comprehensive security for AI agents.”

Request early access and learn more about Agent Commander here. For more information on Veeam, visit https://www.veeam.com/.

RSAC 2026 Conference

To see Agent Commander in action, visit Veeam at Booth S‑427 in the South Hall during RSAC 2026 Conference, March 23-26 in San Francisco, CA. Request a personal meeting or onsite demo here.